China’s Digital Economy Quest

By: Chuck Vollmer

Download report at: http://Jobenomics.com

12 April 2016

Updated 4 September 2016

Download free 16-page report: China’s Digital Economy Quest - 4 September 2016

While the Internet Technology Revolution (ITR) of the 1980/90s and the emerging Network Technology Revolution (NTR) originated in America, these technology revolutions are no longer unique to the United States. China represents the greatest U.S. near-peer competitor for NTR global dominance with emphasis on mastering the emerging digital economy in order to raise hundreds of millions of rural poor out of poverty. China’s transition from a physical (mainly manufacturing) economy to a digital economy is both rapid and impressive. Jobenomics contends that China’s unified economic strategic vision and public-private partnership is more mature and competitive than the United States’ business-as-usual approach.

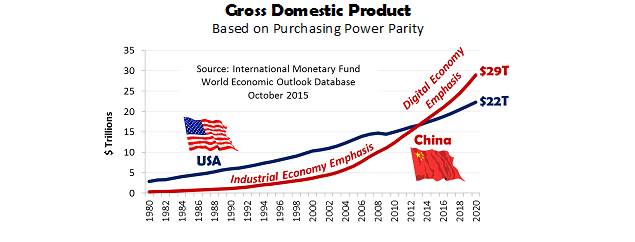

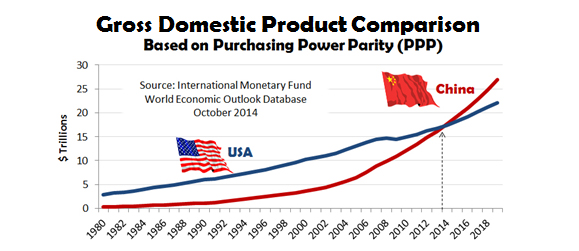

Based largely on China’s manufacturing and employment miracle, China recently overtook the United States in GDP purchasing power parity (i.e., relative value of the U.S. dollar compared to the Chinese yuan) to become the world’s most powerful economy.[1] Over the last two decades, the Chinese have been able to lift 400 million people out of poverty, whereas in the same time period, 15 million more Americans departed the work force than entered it. As the Chinese have proven, small business creation provides for income opportunity and wealth creation for many hundreds of million people. According to McKinsey & Company, the explosive growth of China’s emerging middle class is not over yet. By 2022, McKinsey estimates that more than 75% of China’s urban consumers will earn middle-class wages from $9,000 to $34,000 a year—up from only 4% in year 2000. In purchasing-power-parity terms, this wage range is between the average income of Brazil and Italy.[2] While China has reached parity with the United States in GDP purchasing power parity, it still is a developing country with a GDP per capita of only $15,156 compared to $59,503 for the United States.

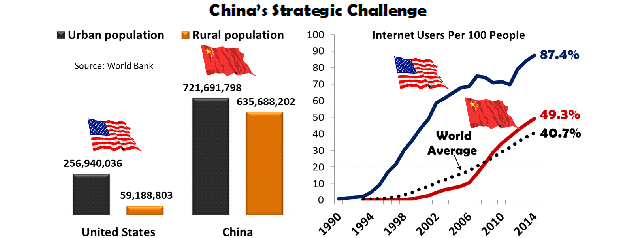

From a Network Technology Revolution perspective, China’s strategic challenge is balancing income disparities between the rural poor and increasingly affluent urban middle-class. Today, China has over 635 million people in rural areas compared to 59 million in the United States. Providing internet services to rural communities is more of a challenge than metropolitan areas with more resources and better infrastructure. While making significant progress over the last decade, China’s percentage of Internet users (49.3%) is only slightly better than the world average (40.7%) and significantly below the United States (87.4%). Of the 649 million Internet Chinese users, 86% (557 million) accessed the internet by phone.[3] Undaunted by these challenges, China is assiduously exploiting the Network Technology Revolution not only overcome domestic inequities but become a world-class model for the rest of the world, including the United States that has comparable challenges in balancing inequalities between rich/poor and urban/rural American communities.

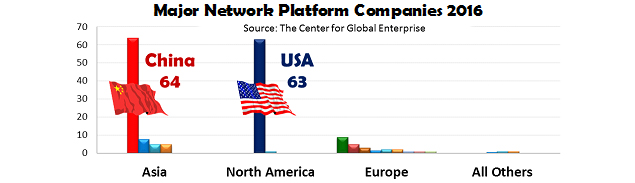

According to The Center for Global Enterprise (CGE), an international nonprofit research institution, there are 176 platform companies worldwide, each with a market valuation of over $1 billion, worth a total of $4.3 trillion in 2016. Asia is home of 82 companies with a market value of $930 billion, followed by North America with 64 companies valued at $3,123 billion, Europe with 27 companies valued at $181 billion and the rest of the world with 4 companies valued at $69 billion.[4]

China and the United States dominate the worldwide network platform business with 64 and 63 major companies respectfully. China’s platform companies include major integrated platform conglomerates (Alibaba, Tencent, Baidu and XiaoMi) and scores of smaller transactional companies (e-tailing, e-commerce, entertainment, etc.). U.S. major companies (Apple, Google, Microsoft, Amazon, Facebook and a dozen others) are currently much larger and have a greater global reach. The U.S. platforms are not only integrated and transactional, but are also foundational in terms of innovation and investment. An innovation platform is a technology, product or service that serves as a foundation on top of which other firms develop complementary technologies, products or services. To a large extent, China’s platform companies have been built on U.S. foundational platforms. However, China’s platform companies are becoming more integrated and innovative at a breathtaking within a government-backed strategic framework that is being implemented across China.

China’s Strategic Framework can best be characterized by Chinese Premier Li’s March 2015 address which urged the Chinese people to “ignite the innovative drive of hundreds of millions of people.” According to the Hong Kong Economic Journal, the oldest and preeminent Chinese business newspaper, Premier Li was referring mainly to the “new China” that is driven by China’s online revolution (aka the Network Technology Revolution).[5] As a result of Li’s address and previous central government dictates, municipalities across China have designated 129 special high-tech zones that have been approved by the State Council and are equipped with the latest NTR technologies, processes and systems to enable mass production of innovative and entrepreneurial startups. The United States has four analogous high-tech hubs in San Francisco (Silicon Valley), New York City, Boston and Seattle.

Chinese Education and Training. China has 1.4 billion compared to America’s 320 million people. Both countries have approximately 20 million students enrolled in higher education. However, China’s higher education growth rate has been explosive—up from 1.4% in 1978 to 20% in 2015[6]—and is likely to continue expanding at current rates with a State-driven, high-technology curriculum emphasis. Chinese students now make up 31% of all international college students at U.S. universities, according to data from the Institute of International Education.

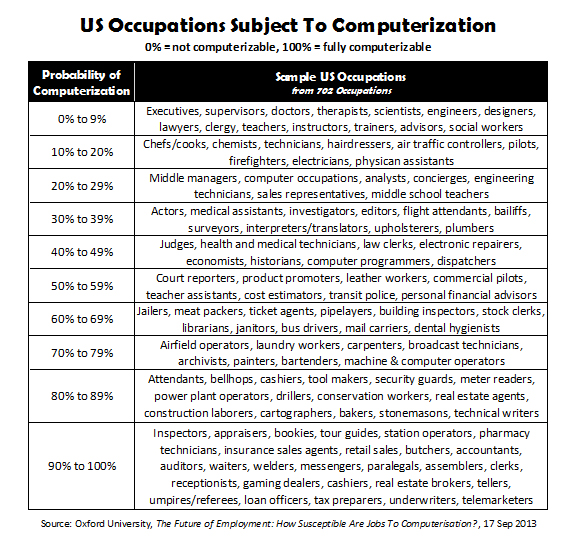

China’s Access to Digital Toolsets and Intellectual Capital. Digital toolsets and intellectual capital are largely free for the taking. According to James McQuivey, Vice President at Forrester Research and the leading analyst tracking the development of digital disruption, China has a well-trained, motivated and entrepreneurial labor force that has access to technologies, distribution partners, supply chains and physical infrastructure that “China didn’t have to pay for because the rest of the world had already seen fit to create them”.[7]

What can’t be freely received can relatively easily be acquired (or hacked) in today’s global economy. According to Randall Coleman, the FBI’s Counterintelligence Division, “China is the most dominant threat we face from economic espionage”. In 2015, the FBI experienced a sharp spike of economic espionage investigations (up over 53% over last year) and that China’s state-sponsored state-sanctioned corporate espionage constituted the bulk of the thefts. [8] [9]

China’s state-driven economic masters are skilled at one-way transactions. If a company wants to do business in China, intellectual capital transfer is part of doing business. For example, in order for Boeing to sell airplanes in China, it is required to manufacture significant portions of the airframe in China along with providing the intellectual capital to do so. The same is true in the digital economy. However, Chinese e-commerce sights are largely closed to imported products and services, but wide open to exported Chinese products and services.

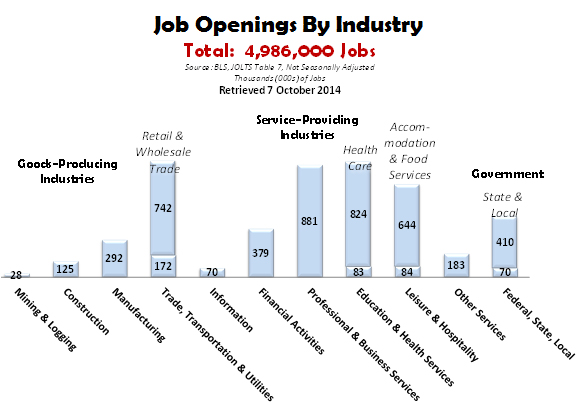

Many major U.S. corporations are now voluntarily training Chinese how to compete in the global digital economy. For example, Tim Cook, Apple’s CEO, has visited China a half-dozen times since he took over for Steve Jobs (who never visited China) in 2011.[10] In 2016, Cook visited China twice and announced that Apple will build its first Asia-Pacific research and development center in the country, largely to boost its flagging iPhone Chinese sales. Sales in Greater China, once touted as Apple’s next growth engine, decreased by a third in mid-2016, after having more than doubled a year earlier. According to Reuters, to further curry favor with Beijing, in May 2016, Apple announced a $1 billion with ride-hailing application made by Didi Chuxing, a Chinese transportation network company headquartered in Beijing and major competitor to American-based Uber in China.[11] In July 2016, Uber decided to pull the plug in China and merged with Didi. Apple is also translating its hardware operating language (iOS) into Mandarin Chinese to make it easier for 850 million native Mandarin speakers to build iOS apps and compete in the highly lucrative app market that is currently dominated by American app developers. In defense of Apple’s Mandarin initiative, the iPhone is China’s leading high-end smartphone. In addition, the United States has more apps-related job openings than it can fulfill. American companies in the medical, health and business services fields have shortfalls of over 50%.

It remains to be seen if Chinese app developers will augment or replace U.S. workers this vital industry. A win-win proposition will require a balanced, reciprocal and transparent playing field. President Reagan used the Russian proverb doveryai no proveryai (trust, but verify) when dealing with the Russians. Perhaps, American politicians and business leaders should be familiar with the equivalent term in Chinese, xìnrèn, dàn yào héchá, when dealing with emerging NTR technologies, processes and systems that underpin the rapidly evolving global digital economy.

Retrospectively, the trust-but-verify adage has proven to be wise advice for many American companies that have invested billions of NTR-related dollars in China. While China continues to the largest market for Apple’s iPhone, other U.S. companies have not fared as well including Google, Facebook, Amazon and Uber. Each company has their own version regarding their failed attempt to exploit the world’s largest emerging market. Some point to anti-competitiveness aspects of the Great Firewall, Chinese Internet surveillance and censorship laws that were designed to protect China from network malfeasance.[12] Others point to Chinese domestic competition that is aided and abetted by the Chinese government. Others claim that their Chinese partners draft on initial Western investment and create clones or knockoffs to usurp the market after it matures and risks are reduced. The Chinese response to these claims is that Chinese markets have always been for the Chinese. One-way transactions were and will continue to be a Chinese priority until the Chinese economy is fully developed. From a Chinese perspective, a better adage is caveat venditor (let the seller beware) or ràng màijiā yào dāngxīn in Chinese.

An increasing number of Chinese e-commerce companies do not require government restrictions to level the playing field to be competitive. WeChat serves as an excellent example. WeChat is China’s leading messaging app, created and produced by Tencent, dwarfs Facebook’s WhatsApp, the world’s leading messaging app, that is freely available in China. WeChat has over 700 monthly users, contains features (voice, browsing, games, payments, etc.) that are tailored to Chinese users and accounts for more than one-third of all the time spent online by Chinese mobile users, according to The Economist.[13] More importantly, WeChat is an example of two-way flow of ideas with Western companies, like Facebook, Google and Microsoft, which are interested in WeChat as an overall mobile operating system as opposed to a mere messaging application.

Chinese Investment Capital. China’s strategic vision also includes business investment. According to the World Bank from 2010 through 2014, gross domestic investment in fixed assets (plants, machinery, equipment and infrastructure) in China was 48% of GDP compared to 19% in the United States. In regard to small business investment, the Vice Chairman Zhou of the China Banking and Regulatory Commission recently stated that “commercial banks must utilize the government’s current policy to further support their financial services to micro and small businesses”. Furthermore, Zhou stated that the CBRC had a high tolerance for non-performing micro and small business loans (currently 3% to 4%) since these businesses are essential to Chinese domestic economic growth. As of May 2014, micro and small business loans were $3.5 trillion (up 17% from a year earlier)[14] compared to U.S. small business loans of $0.6 trillion. [15]

Chinese investment capital is also being effectively used in American NTR-related startups, like Snapchat and Lyft. According to CBInsights, a U.S. datamining company, 2015 saw more than 140 deals including $1B+ financings with Chinese investor participation into SoFi, Uber, and AirBnB. As of May 2016, 40 deals were struck with American tech startups with Chinese investor participation. Since 2010, California took 280 tech startup Chinese investment deals and New York agreed to 40 deals. The most active Chinese NTR conglomerates included Tencent, Alibaba and Renren.[16]

Chinese investment capital does not only come from the quasi-private sector but also from the Chinese central government itself as part of effort to spur entrepreneurship and stimulate a flagging economy. According Bloomberg data, over the last two year the Chinese central government has opened 1,600 high-tech incubators for startups backed by a $340 billion government-guided venture capital fund that comes from tax revenue and state-backed loans. In addition to the central government fund, each of the 23 provinces, 4 municipalities (Beijing, Tianjin, Shanghai, Chongqing) and 5 autonomous regions are creating their own venture capital funds. For example, Hubei Province in Central China raised $30 billion of their $150 billion goal.[17]

Chinese Private Sector Support. American companies are currently the NTR world leaders. However, this is changing. Chinese companies (like Tencent, a social media company; Alibaba and JD.com e-commerce companies; Baidu, a search company; Renren, a social networking service; Xiaomi, the leading Chinese smartphone manufacturer; and NetEase, an online services company) are rapidly assuming global NTR leadership in their respective domains.

The Alibaba Group serves as an excellent example- positioning itself to be a global leading NTR conglomerate specializing in e-commerce. Started in 1999 by Jack Ma, a former Chinese English teacher in Hangzhou, Alibaba’s rise has been historic. Today, Alibaba’s twin pillars the Amazon-like Taobao/Tmall online shopping sites and PayPal-like Alipay online payment system. Alibaba reported a gross merchandise volume of online sale at $485 billion in FY 2016, which is higher than $482 billion of revenues reported by Walmart in its fiscal year 2016. 330 million people made purchases on Alibaba sites last year, spending an average of $1,200. Alipay is now the world’s largest 400 million registered users compared to 188 million for PayPal. Alibaba is also aggressively expanding into e-business related R&D, search, cloud computing, smartphones, finance, crowd funding, private equity, news, messaging, online music, television, motion pictures and sports.

According to Jack Ma, Alibaba was founded[18] “to champion small businesses, in the belief that the Internet would level the playing field by enabling small enterprises to leverage innovation and technology to grow and compete more effectively in the domestic and global economies.” Alibaba’s vision to champion small business creation via the NTR will facilitate prosperity and employment growth to a far greater extent than Google, Microsoft, CISCO, Facebook, IBM or Apple’s narrower product and services-oriented mission/value statements. Ma’s strategic vision fits within China’s strategic framework to become the world’s leading economic power. Founder Jack Ma, at a Clinton Global Initiatives lecture, committed Alibaba to create 100 million global micro-entrepreneur jobs in 2010s via the emerging digital economy—as of 2016, he is well on his way to accomplishing this goal.[19]

Alibaba’s global leadership has been largely underwritten by Americans, starting with U.S. developed NTR technology, processes and systems and major investment by Yahoo and Wall Street’s largest ($22 billion) initial public offering ever at $68 per share. Despite China’s recent economic downturn and Alibaba’s aggressive horizontal and global expansion expenditures that dropped Alibaba’s stock price to $57 per share in August 2015, rebounded by 74% in August 2016 to $99 per share. Most analysts maintain their bullish views on Alibaba Group’s future. Jobenomics agrees and believes that Alibaba has positioned itself well to response to China’s economic downturn and China’s strategic financial needs—building a viable middle class and transitioning China from a physical to a digital economy. Alibaba sales increase indicates an increase in domestic consumption that is vital to Chinese economic growth. To a large extent, China’s economic future depends on the success of Alibaba and other NTR-centric Chinese conglomerates. The same is true for the United States in regard to companies like Amazon other leading NTR-centric American corporations and emerging enterprises.

China’s phenomenal double-digit economic growth has been overwhelmingly manufacturing and urban centric. In order to keep growing, the Chinese government is now pursuing an e-commerce strategy for rural economic development with emphasis on provincial micro-business creation. Chinese companies like, Alibaba and JD.com, are central to this e-commerce strategy. Even with China’s economic downturn, Chinese online consumption grew 33% in 2015, compared to U.S. online sales growth of 15%. The top 500 largest online retailers serving the Chinese e-tailing marketplace grew by an astonishing 57% in 2015. The top 500 is represented by approximately 400 Chinese companies, 50 American companies and 50 other international companies. The growth rate of for the 50 American e-tailing companies in China was 24% compared to 71% for the Chinese counterparts.[20] American growth was due to popular U.S. iconic products, like iPhones, which are increasingly being replaced by higher quality Chinese products and knockoffs.

Alibaba’s phenomenal growth was due largely to urban (Shanghai, Beijing, Tianjin, Guangzhou, etc.) customer loyalty programs, aligning e-commerce to social and entertainment networks, and the creation and financing of approximately 10 million new Chinese microbusinesses. By investing in rural population, which is roughly the same size as the 700 million-strong urban population or twice the size of the entire U.S. population of 320 million, Alibaba hopes to develop a huge new customer loyalty base that has been previously shutout of China’s economic miracle. Alibaba has been aggressively reinvesting its capital reserves in developing a rural e-commerce platform and acquiring peripheral companies and technology to augment this platform. Alibaba is investing $2 billion in training locals, providing free computers, arranging startup financing, and establishing a logistical supply chain to connect 100,000 villages to its e-commerce platform by 2018.

With its revolutionary business model, Alibaba’s Ant Financial has grown to a $60-billion company in just three years and is set to revolutionize the world of finance, with emphasis on rural China. Officially known as Zhejiang Ant Small & Micro Financial Services Group, Ant Financial has its own financial network, money market fund (Yu’ebao) and a credit scoring system with 400 million active users. Just as the name “ant” implies, Ant Financial focuses on the little guy. Most of the active users are poor people who are not rich enough to meet minimum band deposit standards or invest in the stock market. In addition, Ant Financial loans are aimed at helping over 100 million Chinese micro businesses, with emphasis on impoverished rural communities. [21]

In times past, the regime in Beijing would have been skeptical of Alibaba’s grand plan of building millions of microbusinesses at the base of China’s economic pyramid, but times are different now. The regime knows that domestic household consumption (36% in China compared to 69% in the United States[22]) must increase significantly in order to please the masses and allow the new Chinese digital economy to grow without dependency on the rest of the world as is the case with today’s manufacturing-oriented economy.

The regime also knows that its large private sector businesses can create small businesses faster and better than the government can. In June 2015, Premier Li publicly stated that the central government is supporting (via tax breaks, underwriting small business loans, and cutting red tape) “migrant workers, college graduates and army veterans who wish to return to their rural hometowns to start new businesses, part of a national campaign to boost entrepreneurship and employment”. The Chinese government is also supporting e-commerce companies, like Alibaba, to set up “consumption finance” firms and offering these companies equal access to public services (social insurance, housing, education and healthcare) in order to encourage citizens to seek new careers or start microbusinesses in rural regions.[23]

Chinese e-Commerce Boom. According to a Nielsen Global Survey, 98% of Chinese respondents made online purchases during the year with emphasis on household consumables and products. From June 2014 to June 2015, sales of groceries climbed 52%, beverages 72% and products 86%. In addition to purchasing, the entire Chinese retail experience is being transformed by new NTR technology from the retail experience through the complete supply chain and delivery services. According to the report, most Chinese consumers still prefer using their computers to make online purchases but Chinese mobile purchases are increasing rapidly in comparison the rest of the world. “Chinese dependence on mobile phone apps to place orders is far higher than in other surveyed countries, with 98% meal delivery services, 95% baby and children products, 91% IT and mobile goods and 90% packaged grocery food, were made via apps on smartphones.” The use of digital payment systems in China is far higher (86%) than the average (43%) of the 26 surveyed countries. [24]

Conclusion. It will be interesting to see if China can replicate its manufacturing economic miracle in the digital world.

A pessimist would argue that a centralized economy controlled by ideological forces will eventually stifle creativity offered by a free and open marketplace. An optimist would argue that while only half of its citizens are currently connected to the internet, China’s rate of internet user growth has been significant, especially considering population size and geographical constraints of the country.

Furthermore, an optimist would counter with an assertion that China is likely to succeed based on China’s strategic framework, commitment to higher education and training, access to “free” digital toolsets and intellectual capital, generous amount of investment capital for business development and enthusiastic private sector support.

Jobenomics takes the position that China will likely achieve NTR dominance over in China and its strategic partners, but is likely fall short of global dominance unless its digital economy becomes more transparent, open and reciprocal with all of its global trading partners. NTR dominance does not have to be a zero-sum game but will likely be, especially over the next decade. Jobenomics believes that the emerging digital economy offers a unique ecosystem where China and the United States could cooperate to create a global digital economy that would lift all economies to the benefit of the global whole.

[1] International Monetary Fund, , World Economic Outlook Database, October 2014, http://www.imf.org/external/pubs/ft/weo/2014/02/weodata/index.aspx

[2] McKinsey & Company, Mapping China’s middle class, June 2013, http://www.mckinsey.com/insights/consumer_and_retail/mapping_chinas_middle_class

[3] The World Bank, Data, Internet users (per 100 people), http://data.worldbank.org/indicator/IT.NET.USER.P2

[4] The Center for Global Enterprise, The Rise of the Platform Enterprise: A Global Survey, January 2016, http://thecge.net/wp-content/uploads/2016/01/PDF-WEB-Platform-Survey_01_12.pdf

[5] Hong Kong Economic Journal (ejinsight), How China is replicating Silicon Valley on a grand scale, 24 July 2015, http://www.ejinsight.com/20150724-how-china-is-replicating-silicon-valley-on-a-grand-scale/, also reported by Bloomberg Business, China Wants Silicon Valley’s Everywhere, 23 July 2015, http://www.bloomberg.com/news/articles/2015-07-23/china-wants-silicon-valleys-everywhere

[6] China Education Center, http://www.chinaeducenter.com/en/cedu.php

[7] James McQuivey, Digital Disruption: Unleashing the Next Wave of Innovation, Figure 1-1: Digital Disruption Creates One Hundred Times the Innovation Power, Page 11.

[8] CNN, FBI sees Chinese involvement amid sharp rise in economic espionage cases, 24 July 2015, http://www.cnn.com/2015/07/24/politics/fbi-economic-espionage/

[9] Federal Bureau of Investigation, Testimony of Randall C. Coleman, Assistant Director, Counterintelligence Division, Statement Before the Senate Judiciary Committee, Subcommittee on Crime and Terrorism, Washington, D.C., 13 May 2014, https://www.fbi.gov/news/testimony/combating-economic-espionage-and-trade-secret-theft

[10] Bloomberg BusinessWeek, 10-23 August 2015 Technology Section, Developers Teach Apple Chinese, Page 36

[11] Reuters, Apple to increase investment in increasingly tough China, 16 August 2016, http://www.reuters.com/article/us-apple-china-idUSKCN10R14G

[12] The Great Firewall of China is a major element of the Golden Shield Project designed to identify and block unfavorable data from foreign countries and is operated by the Ministry of Public Security. Great Firewall hardware was designed and provided by mostly U.S. companies, like Cisco Systems.

[13] The Economist, Technology in China, China’s tech trailblazers: The Western caricature of Chinese internet firms needs a reboot, 6 August 2016, http://www.economist.com/news/leaders/21703371-western-caricature-chinese-internet-firms-needs-reboot-chinau2019s-tech-trailblazers

[14] Reuters, China pushes for more small business lending despite bad loans rising, 8 May 2015, http://www.reuters.com/article/2015/05/08/us-china-economy-idUSKBN0NT0O320150508

[15] U.S. Small Business Association, Small Business Lending in the United States 2013 (Published December 2014), Table B. Value of Small Business Loans Outstanding by Loan Type and Size through June 2014, https://www.sba.gov/sites/default/files/2013-Small-Business-Lending-Study.pdf

[16] CBInsights, The Rise Of Chinese Investors Into US Tech Companies, 19 May 2016, https://www.cbinsights.com/blog/chinese-investment-us-tech-startups/

[17] Bloomberg Technology, Inside China’s Historic $338 Billion Tech Startup Experiment, 8 March 2016, http://www.bloomberg.com/news/articles/2016-03-08/china-state-backed-venture-funds-tripled-to-338-billion-in-2015

[18] Kauffman Foundation, The Importance of Startups in Job Creation and Job Destruction, Last Paragraph, 9 Sep 2010, http://www.kauffman.org/what-we-do/research/firm-formation-and-growth-series/the-importance-of-startups-in-job-creation-and-job-destruction

[19] NING, 100millionjobscrisis, Video, 23 November 2009, http://yunusasia.ning.com/video/100millionjobcrisis-1

[20] Internet Retailer 2016 China 500, 2016 China 500 Executive Report, https://www.internetretailer.com/shop/2016-china-500-executive-report.html

[21] Cheung Kong Graduate School of Business Knowledge Center (Beijing), Will Ant Financial Become Wildly Successful Like Taobao?, 24 May 2016, http://knowledge.ckgsb.edu.cn/2016/05/24/internet-finance/will-ant-financial-become-wildly-successful-like-taobao/?utm_campaign=shareaholic&utm_medium=email_this&utm_source=email

[22] The World Bank, Household final consumption expenditure, etc. (% of GDP), retrieved August 2015, http://data.worldbank.org/indicator/NE.CON.PETC.ZS

[23] Xinhua News Agency, Xinhuanet, China supports entrepreneurship in rural areas, 10 June 2015, http://news.xinhuanet.com/english/2015-06/10/c_134315560.htm

[24] Nielsen Global Survey, China Maintains Robust E-Commerce Growth, 1 March 2016, http://www.nielsen.com/cn/en/insights/news/2016/china-maintains-robust-e-commerce-growth.html