Download PDF Version: Consumption-Based Economy 2 Sep 2013

2 September 2013

The USA is a consumption-based economy and America is a consumption-driven society. Neither fact is necessarily good or bad. It is the way America has operated for a century. The issues at hand are (1) whether America can sustain high rates of consumption in an ever changing geo-political/economic environment, and (2) what are the consequences of a reduced consumption-based economy?

Consumption is an economic function that is defined as the value of all goods and services bought by people. Leading economists determine the performance of a country in terms of consumption level and consumer dynamics. The underlying theory of a consumption-based economy is that progressively greater consumption of goods is economically beneficial. Jobenomics believes that this theory is only partly true. Production, not consumption, is the true source of wealth. Production uses resources to create goods and services that are suitable for use or exchange in a market economy. If America wants a healthy economy, we need to create the conditions under which producers (businesses as opposed to governments) can accelerate the process of creating wealth for others to consume and finance future production.

To better understand the dynamics of our consumption-based economy, let’s first examine US consumption statistics, and then address consumption-based economy sustainability, potential consequences of reduced consumption, and Jobenomics recommendations.

US Consumption Statistics. The US is consumption-based society where spending and consumption of goods and services are essential to economic health. In America’s pre-consumer era, the US economy was based on agriculture and cottage industries where citizens produced what they needed and traded the rest. Non essential consumption was largely the privilege of an elite few. Over the last century, consumerism was introduced to the masses as part of the American economic equation. Today, consumption is no longer a privilege but a necessity. Increased consumption is necessary to keep the economy growing. Without increased consumption, the economy would falter.

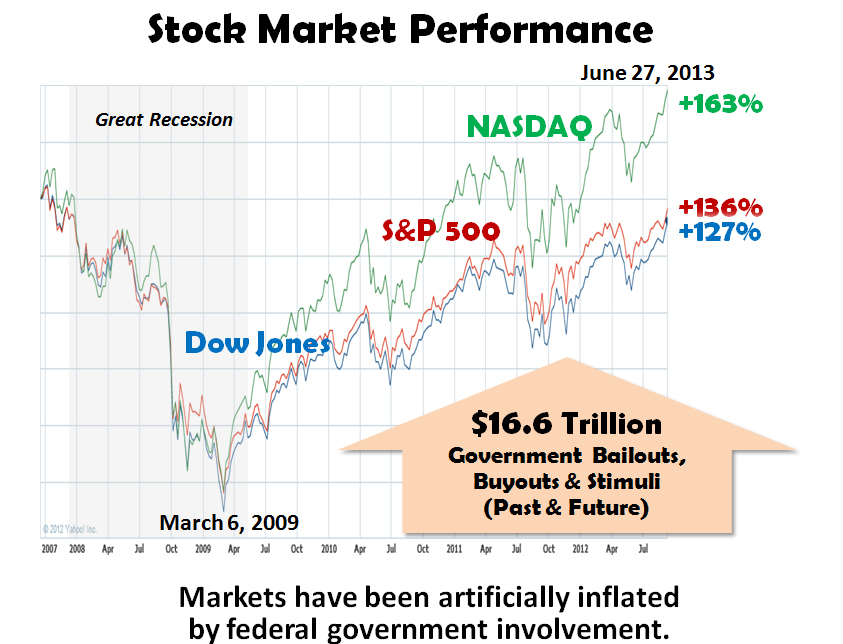

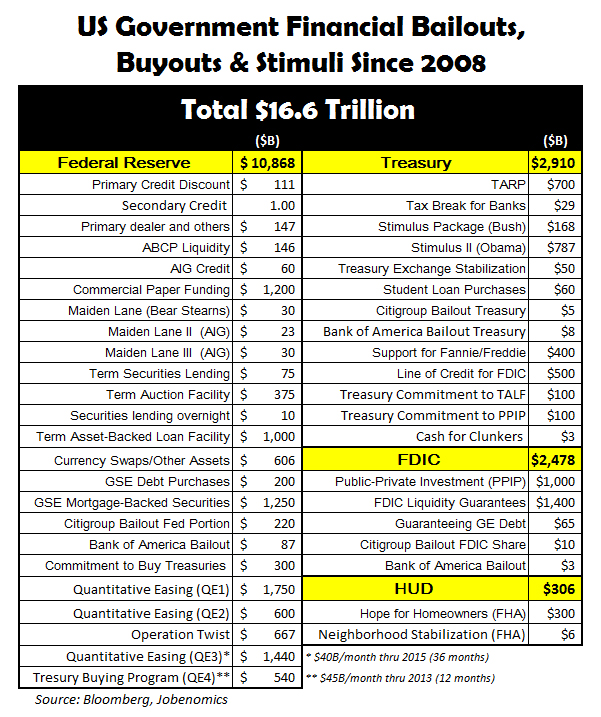

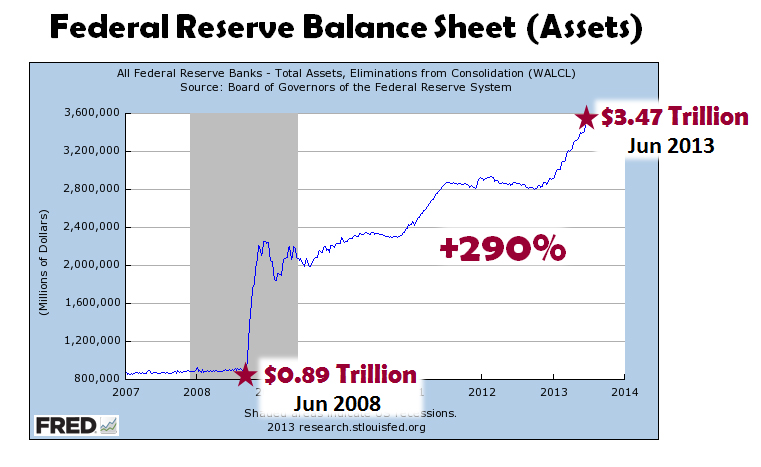

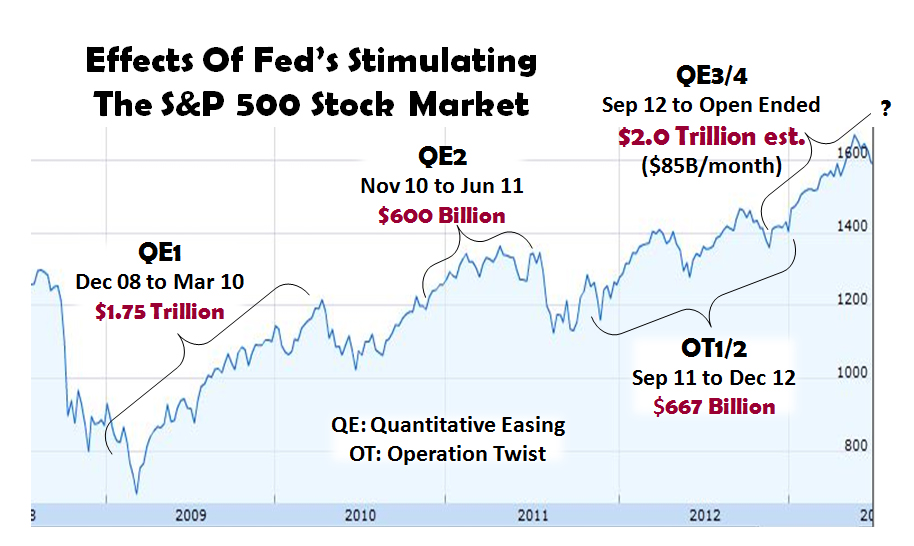

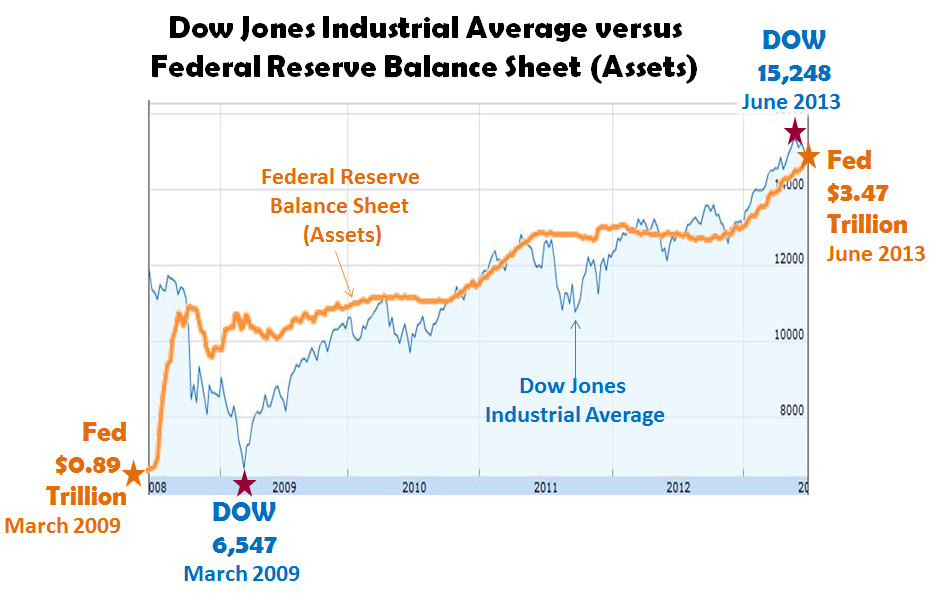

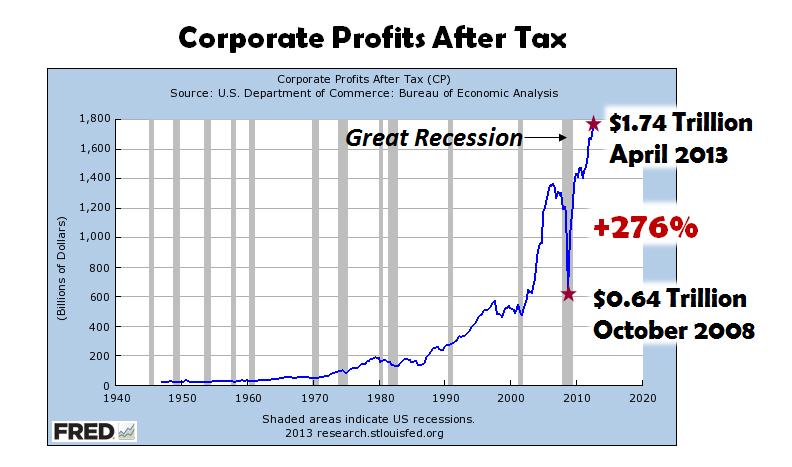

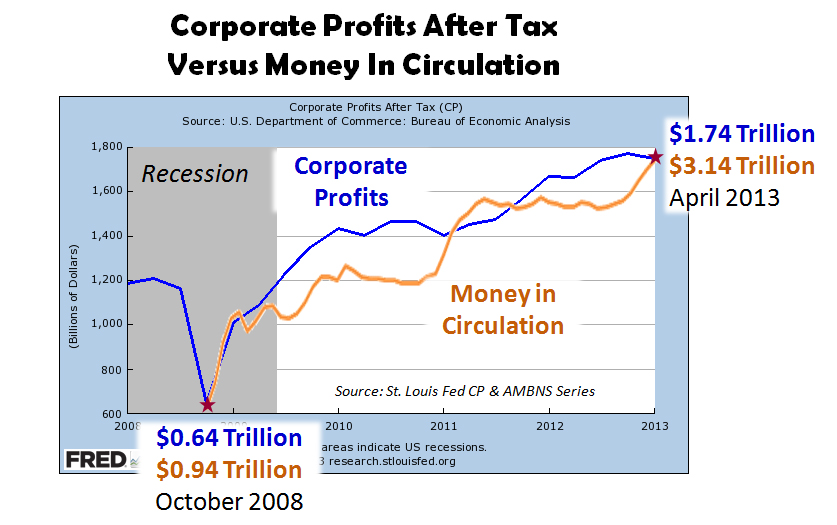

To sustain a growing economy, government, financial institutions and corporations must motivate citizens to keep consuming to preserve our way of life. Modern-day Americans are programmed to be good consumers. It is estimated[1] that an average American child watches 20,000 TV commercials per year. By age 65, the average American watches 2 million commercials. We are programmed for mega-consumption for special occasions, like Christmas that evokes $80 billion worth of gift-giving. When an event, like 9/11 or the Great Recession of 2008-09, happens the federal government steps in to encourage consumption. The Monday following the 9/11 Trade Tower attacks, the White House encouraged American’s to continue shopping due to fears that Wall Street would falter if consumer confidence plummeted. At the advent of the Great Recession, the federal government implemented a series of bailouts, buyouts and stimuli to keep financial institutions and corporations afloat in order to stimulate our consumption-based economy. These federal stimuli continue today to the tune of $16.6 trillion (see http://jobenomicsblog.com/stock-markets-and-the-fed), which is in addition to the $3.5 trillion spent annually for federal goods and services.

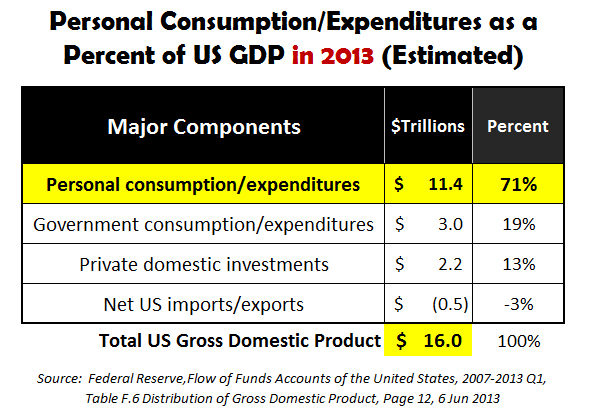

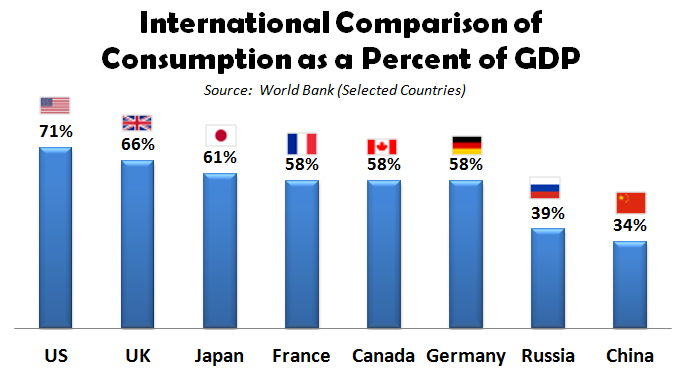

According to The World Bank[2], the United States is the largest and most conspicuous consumption-based economy in the world. As shown, the US leads the world with 71% consumption as a percent of US gross domestic product (GDP, the sum of all goods and services produced in the US by Americans). Other Western economies average about 60%. Emerging economies average around 35%.

China, as true with many developing countries, depends on government-funded investment to encourage economic expansion. Chinese household consumption expenditure is 34% where government investment is approximately 54%. Most of this government investment comes from the Chinese government to large state-owned corporations that are granted easy access to capital for development of factories, real estate and infrastructure.

The overwhelming percentage of GDP is generated by personal consumption and expenditures as shown above. The US Federal Reserve System (the central bank of the United States) reports monthly[3] on the various components US GDP. For 2013, personal consumption and expenditures amounts to $11.4 trillion out of a total GDP of $16.0 trillion, or 71% of the total. Government consumption, expenditures and investments amount to $3.0 trillion, or 20% of the total. Private domestic investment (mainly businesses and real estate investments) accounts for $2.2 trillion, or 13%. The final component is net US imports/exports, which is a negative $500 billion (-4%) since foreign imports exceed US overseas exports in our consumption-based economy.

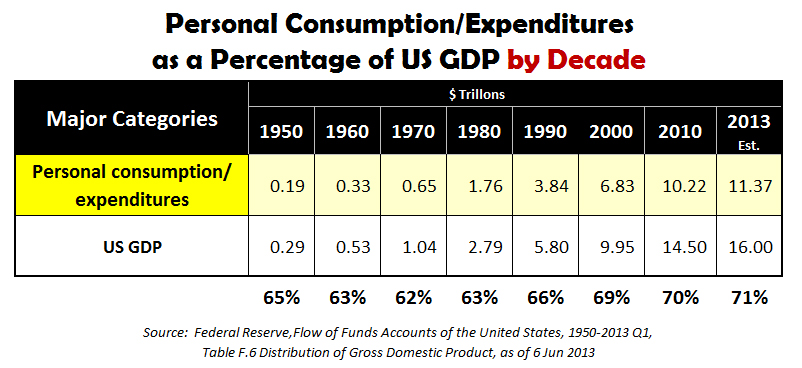

US personal consumption rose over the last seven decades as a percentage of US GDP—ranging from a low of 62% to a high of 71% today. It is interesting to note that the two recessions in the decade of the 2000s did not decrease the ever growing amount of consumer spending.

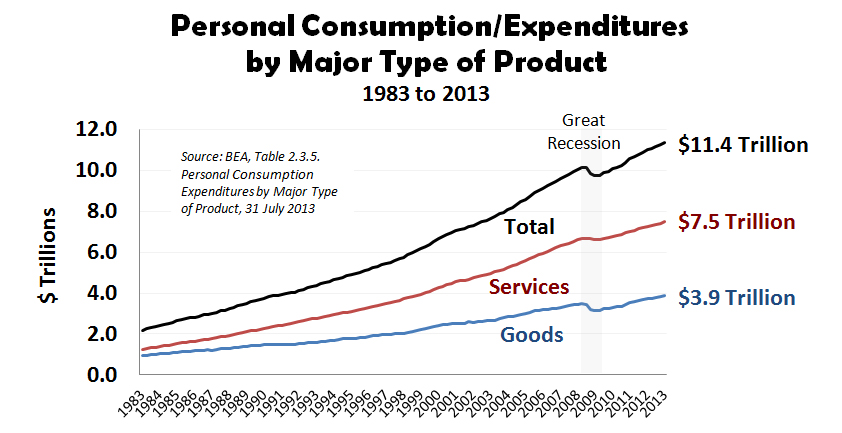

As estimated by the US Bureau of Economic Analysis[4], personal consumer spending has reached an all time high of $11.4 trillion in year 2013. From 1959 (earliest BEA records) to 1970, consumption of goods exceeded services. After 1970, services rapidly exceeded goods. Today, the US consumes $7.5 trillion worth of services and $3.9 trillion worth of goods. In other words, the US is a services-oriented, consumption-based society by a factor of almost 2 to 1.

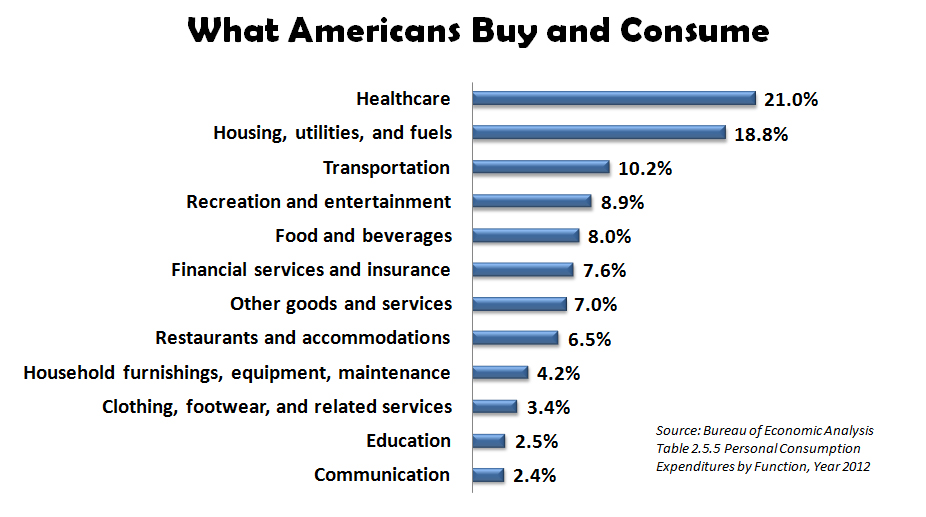

Americans consume a vast variety of goods and services[5] with healthcare (21.0%), housing (18.8%) and recreation/entertainment (10.2%) topping the list. Surprisingly, Americans spend more on entertaining themselves (recreation and entertainment, 8.9%) than they do on groceries (food and beverages, 8%)—a sign of “conspicuous consumption”.

Conspicuous consumption is generally defined as spending on goods and services mainly for the purpose of displaying income, wealth or social status. Consumers naturally want the latest gizmos and to keep up with the “Jones”. However, advertising, easy money (credit) and federal stimuli encourage consumption practices that far outstrip our ability to pay. It is this inability to pay—both in government and the private sectors—that puts the American economy at risk.

America has a consumption conundrum. On one hand, the US economy is dominated by consumption (71%) that must be maintained in order for the economy to prosper. On the other hand, conspicuous, unneeded or unessential consumption without the ability to repay spiraling indebtedness risks defaults, ever higher interest rates, and bankruptcy. Approximately 50,000 businesses and 1 million individuals file for bankruptcy each year[6]. Bankruptcies in major cities, like Stockton, Harrisburg and Detroit, indicate that something is amiss.

Consumption-Based Economy Sustainability. Is our consumption-based economy sustainable? Jobenomics assesses the short-term outlook as favorable and the long-term outlook as unfavorable. However, the long-term outlook could be favorable if the American populace and their elected leaders exploit the advantages of the US labor force and solve a number of significant challenges facing US economic growth.

Americans have a number of advantages in regard to the global economy. Primary advantages include inertia, innovation, adaptability, natural resources, and the dollar as the world’s currency—all of which will sustain the US economy in the short-term.

- In physics, inertia is defined as a property of matter to retain its momentum in the absence of an external force. The same is true of our consumption-based economy that has retained momentum over the last five decades as shown on the 1959 to 2012 Personal Consumption/Expenditures by Major Types of Product chart . Even the Great Recession of 2008-2009 caused only a temporary speed-bump in US personal consumption expenditures. Even with all its challenges, the US economy is still the largest, most vibrant and the most stable in the world.

- Innovation is part of the American fabric. Historically, Americans have been the first to embrace disruptive technologies that transform life, business and the global economy. US innovators and entrepreneurs have revolutionized our society many times in the last century from the military-technological revolution in the 1950s/60s, to the information-technology revolution in the 1980s/90s and todays energy-technology revolution.

- Americans adapt to change. Within the last 200 years, Americans transitioned from: pre-consumer to consumption-based, agriculturally-based to industrial-based, industrially-based to information technology-based, from dependence on goods to services, as well as rural to urban. In 1810, only 6.1% of Americans lived in cities. By 1910, 45.6% lived in cities. Today, 80.7% of all Americans live are urbanites.

- Unlike most countries, America has ample resources. The most important resource is human. When we run short of human resources, America has been able to attract and retain foreign talent. The second most important resources is natural. We have abundant supply of arable land, water and energy. Our challenge is to husband these resources in an economically and environmentally balanced way.

- The dollar is the world’s reserve currency. While there is a lot of talk about replacing the dollar with a new form of global currency based on a “basket” of currencies or commodities, the dollar should remain the world’s currency in near future. Being the world’s reserve currency, allows the US federal government to print and borrow money to manage its cash flow needs. This is not true of almost any other country on earth.

However, America has a number of significant challenges to include debt/deficits, fiscal/monetary policy, financial disruptions and demographics that could upend our consumption-based economy.

- The US is now the greatest debtor nation in the world. Over-consumption caused US private and public debt (the total of all US government, households, corporations and financial institutions) to surge upward to $45 trillion, or 300% of US GDP. Eventually these debts will be reconciled via dollar devaluation, increased interest payments, defaults or high inflation.

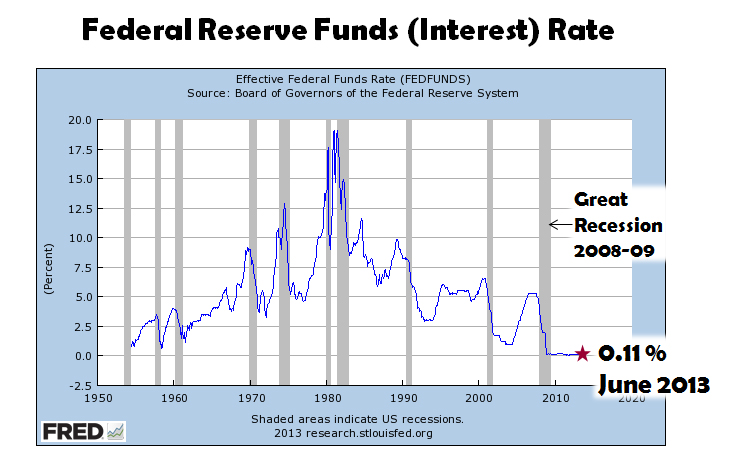

- The US Congress is responsible for fiscal policy (tax and spending) and the US Federal Reserve System is responsible for monetary policy (printing money and setting interest rates). As long as the US Congress spends $1 trillion more each year than it takes in taxes and the Fed continues to stimulate the economy at an average of $1 trillion a year, consumption will continue unabated with copious amounts of “easy” money. This rate of spending cannot last. Hopefully, the US economy will strong enough to operate on its own when government stimuli end.

- Domestic financial disruptions, like recessions and periods of inflation, and occur frequently. Since WWII, the US averaged 1.7 recessions per decade. So far in this decade (2010 to today), the US has been recession-free mainly due to infusion of trillions of dollars worth of government stimuli. Inflation is also a major consideration. So far in 2013, inflation has averaged 1.5%, which is in the normal range. In 2008, prior to the Great Recession, it was 5.6%. In 1980, it was 14.7%. When government stimuli end, many fear that inflation will increase, perhaps significantly. The next recession and/or an inflationary spiral could be very deleterious to consumption.

- Global financial disruptions caused by political, economic, military or social malfeasance could trigger changes to US consumption. Europe and Japan are in recession. Conflicts in the Middle East continue. Competition from China remains unabated. It is unlikely that a single global disruption will have a significant impact on US consumption. However, a global disruption may have a multiplying effect making a domestic financial disruption worse. Multiple or cascading global disruptions, especially with our key trading partners, would certainly have an adverse affect on the US economy.

- US demographic trends signal reduced consumption. 78 million baby-boomers just began to retire. Retirees are generally fiscally conservative and less prone to large expenditures. The other demographic group that is buying less is the middle class. Since year 2000, the middle class has decreased by approximately 6%. In the same period of time, the number of able-bodied Americans that can work but choose not to work has grown by 20 million people to a total of 90 million, not including 70 million people that cannot work, out of a total population of 316 million.

Potential Consequences of Reduced Consumption. Depending how the US economy is managed or mismanaged, the consequences of reduced consumption can range from benign to malignant. The longer we wait to implement meaningful reforms to our long-term challenges the more severe the consequences of reduced consumption.

Unemployment is directly tied to consumption. One can roughly calculate the consequence a relatively minor drop of 5% in consumption and its impact on unemployment. A 5% reduction in the US $16 trillion annual GDP would precipitate a loss of approximately 20 million jobs ($16 trillion GDP x 5% = $800 billion/$40,000 annual median personal income = 20,000,000 jobs). Today, the US employs a total of 136 million citizens, so a reduction of 20 million jobs would equate to approximately 15% of the US work force. If the layoffs were focused on the poor and the lower middle class making an average personal income of $20,000, the numbers could double.

As shown on the International Comparison chart at the beginning of this article, a 5% reduction in GDP would still make the US highest consuming society tied with the UK at 66%. Given the volatility in today’s geo-political/economic environment, financial disruptions should be anticipated. Given the severity, duration and number of disruptions, a 5% (or greater) drop is certainly in the realm of the possible.

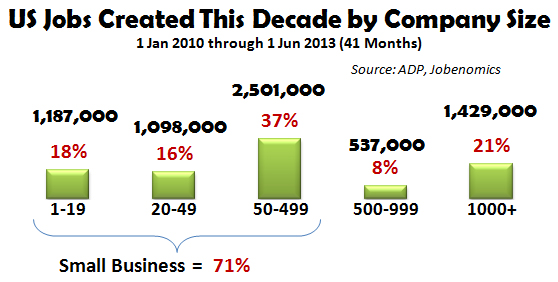

Jobenomics Recommendations. Jobenomics believes that the best way to mitigate the effects of a potential consumption downturn is to promote small business growth as opposed to massive stimulus packages oriented to government jobs, big business and large financial institutions. Since the beginning of this decade (2010s), small business produced 71% of all new jobs. Today small business employs 77% of the US labor force (see: Jobenomics Employment Report-August-2013).

Jobenomics also believes that a national initiative involving small, emerging and self-employed business creation would be an insurance policy against future economic downturns. The creation of 20 million new jobs via small businesses—the engine of the US economy—would mitigate potential reduction of 20 million jobs as calculated above.

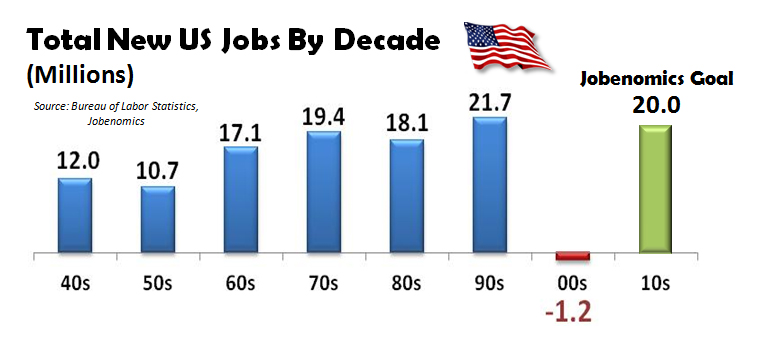

In the 1970s, 1980s and 1990s, the US created an average of 20 million new jobs each decade and can do so again. However, this amount of growth will not transpire using traditional methods. Jobenomics believes that America needs to focus a model based on sustainability and self-sufficiency enabled by emerging information technologies and an improved national info-structure. Jobenomics advocates a transition from dependency on large urban institutions to more independent small rural and virtual business networks. This does mean that we abandon our current model but supplement it with alternatives that have the highest probability for scalability and growth.

Jobenomics is working on three highly-scalable, small business initiatives that could create millions of new jobs. These initiatives include: (1) a national effort for Generation Y to monetize social networks via a modernized info-structure, (2) a national direct-care effort to accommodate the aging and children via substantially increasing the number of women-owned businesses, and (3) a national effort to monetize waste streams via waste-to-energy and waste-to-raw materials that could rejuvenate depressed inner cities and the financially disadvantaged.

These three fledging initiatives are representative of the efforts of several hundred dedicated individuals—imagine what our nation could do writ-large.

[1] The Sourcebook for Teaching Science – Strategies, Activities, and Instructional Resources, Television Statistics, IV. Commercialism, http://www.csun.edu/science/health/docs/tv&health.html

[2] World Bank, Household final consumption expenditure, etc. (% of GDP), http://data.worldbank.org/indicator/NE.CON.PETC.ZS

[3] Federal Reserve, Flow of Funds Accounts of the United States, 2007-2013 Q1, Table F.6 Distribution of Gross Domestic Product, Page 12, 6 Jun 2013, http://www.federalreserve.gov/releases/z1/Current/z1.pdf

[4] US Department of Commerce, Bureau of Economic Analysis, Table 2.3.5U Personal Consumption Expenditures by Major Type of Product and by Major Function, 7 August 2013, http://www.bea.gov/itable/iTable.cfm?ReqID=12&step=1#reqid=12&step=3&isuri=1&1203=14

[5] US Department of Commerce, Bureau of Economic Analysis, Table 2.5.5 Personal Consumption Expenditures by Function, 7 August 2013, http://www.bea.gov/iTable/iTable.cfm?reqid=9&step=3&isuri=1&903=69#reqid=9&step=3&isuri=1&910=X&911=0&903=74&904=2004&905=1000&906=Q

[6] American Bankruptcy Institute, Annual Business and Non-business Filings by Year (1980-2012), Year 2012, http://www.abiworld.org/AM/AMTemplate.cfm?Section=Home&CONTENTID=66471&TEMPLATE=/CM/ContentDisplay.cfm