Download PDF Version: Jobenomics Urban Mining 10 July 2013

10 July 2013

One of the Jobenomics strategic initiatives involves urban mining. Urban mining is defined as a process of reclaiming raw materials from products, buildings and waste from towns, cities and metropolitan areas. The goal of urban mining is to monetize urban waste streams including construction & demolition material (C&D), municipal solid waste (MSW), electronic waste (appliances, commuters/peripherals, and other electronic items) and tires (car, truck and rubber products). Every community in America should look to urban mining to (1) recover (waste-to-materials) or convert (waste-to-energy) their waste streams, (2) reduce landfilling and exporting of raw materials, and (3) creating new businesses and jobs.

The goal of urban mining is to monetize urban waste streams. These waste streams contain combustible and non-combustible materials. Combustibles are those items that have caloric value that can be converted to electrical power via waste-to-energy systems. Non-combustibles, such as items containing metals, can be decomposed to retrieve raw materials via waste-to-materials processes.

Waste-to-Energy. Jobenomics is working with several waste-to-energy companies to monetize waste streams by converting MSW and C&D material to electrical power. Waste-to-energy systems can use incineration, pyrolysis, plasma or gasification processes. Incineration (burning) is oldest and most common process, but is generally considered the dirtiest. Pyrolysis burns waste material in an oxygen-free environment and produces carbon black, a material used in paints and toner cartridges, oil/tar and synthetic gas. Pyrolysis is becoming increasingly popular but produces lots of ash and is expensive. Plasma, which is essentially lightning in a bottle, is the most modern but yet unproven. Due to plasma’s ultra-high temperatures (2000°C), plasma is ideally suited for eliminating toxic and nuclear waste. Gasification is in use in 10 countries and is considered to be the cleanest and most cost effective waste-to-energy system that produces synthetic gas from organic materials.

Waste-to-Materials. Jobenomics calculates that a waste-to-materials program can produce over $30 million worth of annual profits for a small to medium sized city. Unfortunately, most city managers do not realize that they forego this source of revenue by landfilling or exporting items that contain high value raw materials, such as those contained in electronic waste and scrap tires.

Jobenomics defines electronic waste as IT-related e-waste, whiteware and brownware.

- IT-Related E-Waste. IT-related e-waste is the fastest growing municipal waste stream in the US. The US Environmental Protection Agency (EPA) defines e-waste as computers and assorted peripherals, hardcopy devices (printers, fax machines, etc.), televisions and mobile devices—not including whiteware or brownware. The latest EPA e-waste report[1] states that, in 2009, 2.37 million tons of IT-related e-waste was ready for end of life management with 5 million tons in storage. The EPA calculates that 75% went to landfills and 25% was recycled. Of the amount recycled, EPA estimated that 80% was shipped to foreign countries (mainly China, India and Nigeria) where the extraction process is unregulated and often unsafe. The EPA reports that IT-related e-waste grew by 120% from 1999 to 2009 and will continue to grow at or exceeding this rate with advent of mobile computing devices replacing desktop and laptop computers and flat panel TVs replacing TVs with cathode ray tubes (CRTs).

- Whiteware. The EPA also reports[2] that approximately 16 million refrigerators, air conditioners and dehumidifiers are disposed of each year. In 2009, the EPA[3] estimates 3.7 million tons of major appliances were discarded in the municipal solid waste stream. These appliances need special handling due to the ozone-depleting refrigerants and foam blowing agents they contain. In addition to appliances that contain refrigerants, the US disposes an untold amount of other whiteware including 8 million vending machines and tens of millions of stoves, dishwashers, HVAC systems, water heaters, ducting, wiring and light fixtures. National disasters, like hurricanes and tornados, produce vast stockpiles of whiteware from destroyed homes and businesses.

- Brownware. In 2009, the EPA[4] estimates that Municipal Solid Waste streams contained 20.4 million tons of miscellaneous durable goods (consumer electronics such as television sets, videocassette recorders, and personal computers; luggage; sporting equipment, etc.). The EPA does not report on brownware that includes discarded items like radios, telephones, stereo equipment and components, space heaters, microwave ovens, minor kitchen and home appliances (toasters, mixers, vacuum cleaners, etc.), power and electronic garden tools, lamps and lighting equipment, toner cartridges, CDs/DVDs, and personal electronic devices (such as, hair dryers, headsets, etc.). Throughout Europe, it is not uncommon to see collection boxes for brownware as the one shown in the picture below. It is estimated that tens of millions of tons of brownware are routinely discarded in garbage cans and buried in landfills as part of the municipal solid waste stream.

- Scrap Tires. In addition to electronic waste, the USA discards approximately 300 million scrap tires per year. Primary scrap tire markets include: tire-derived fuel, civil engineering, and ground rubber/rubberized asphalt applications. In the US, the primary means of disposal of scrap tires is tire-derive fuel due to their high heating value. The typical selling price for tire-derived fuel is approximately $50/ton. Pyrolysis of waste tires generates combustible gases, oil, and char products. Cryogenics processes (in use in Europe) produce fine rubber powders that can sell for as much as $8,000/ton.

America is decades behind Europe in terms of recycling electronic waste (IT-related e-waste, whiteware and brownware). Germany and France uses technology to sort, process, shred, segregate and sell raw materials generated by the decomposition of electronic waste. This is not only economically sound but significantly reduces the need for landfilling. As stated earlier, Americans only recycle about 5% of annually produced e-waste not including whiteware and brownware, or the vast quantities in storage and landfills. However, America environment concerns are changing and 25 states have moratoriums on placing electronic waste in landfills. These moratoriums have led to increased exporting as well as domestic recycling. In addition, the number of US landfills have decreased from 7,924 in 1988 to 1,908 in 2009[1]—a decrease of 76% in two decades.

Regarding exporting, over the last year, Jobenomics has met with dozens of US city managers regarding the disposition of electronic waste, landfill conversion and urban mining. Virtually all of the city managers (mayors, city councils, solid waste managers) were unaware that they were foregoing such a lucrative source of revenue and were very interested in how Europeans were monetizing their waste streams. They were also unaware that most of their policies and procedures encouraged exporting electronic waste overseas as opposed to domestic recycling. For example, many government solid waste managers acknowledge that they work with companies whose sole purpose is to identify high-value electronic waste items (computers, refrigerators) for shipment to China. These companies would buy high-value items for pennies on the dollar and use the empty 40 foot containers that the Chinese use to ship their exports to the US to export our high-value materials back to China. The non-high-value items were discarded in local landfills paid by taxpayers.

Regarding domestic recycling, despite the rhetoric, America is in the infancy of recycling compared to Europe. Of the 3,000+ American recycling companies, the vast majority (99%) use manual processes to strip out the highest value materials, like copper, and discard the remaining materials in landfills. Jobenomics estimates that less than 100 recycling companies use advanced processes to de-manufacture or shred electronic waste to obtain raw materials. Most of these companies are niche recyclers that focus on high-value items like cell phones and computer mother boards. Perhaps the leading US recycler is Electronics Recycling International (ERI) that processes over 80,000 tons annually in seven states with collection facilities in all 50 states. ERI’s CEO is credited with creating the term “urban mining”.

Jobenomics believes that companies like ERI are essential to processing the tens of millions of tons of US electronic waste that is increasing every year. Considering the advent of cloud and mobile computing as well as flat panel TVs, this trend will likely continue into the foreseeable future. Since ERI only processes only 3% of the narrowly defined e-waste market, hundreds more companies like ERI will be needed to process the entirety of the electronics waste stream that is produced annually plus the amount in storage (homes, businesses and warehouses) and landfills (both sequestered above ground and buried beneath). In order to meet this massive environmental challenge, Jobenomics also endorses the European model of locally owned and operated micro-processing facilities.

Jobenomics visited European electronic waste processing plants in Germany, France and Poland. As a result of these visits, Jobenomics created a company, called eCyclingUSA (www.eCyclingUSA.com) that is partnered with the leading European manufacturer (CHEMA Environment GmbH, a division of SYSTEC, Germany) of state-of-the-art urban mining systems: MSW sorters, Single Stream Recycling Systems, Electronic Waste Recycling and Rubber Tire Recycling systems. SYSTEC currently designs turnkey plants in use in 60 facilities throughout Europe that produce an annual profit of approximately $30 million per year for their respective communities.

There are no comparable US plants that shred IT-related e-waste, whiteware and brownware, and separates the raw materials (copper, aluminum, iron, plastics) in minutes into pellet form.

These pellets/powders are aggregated by raw material type and packaged for sale to commodity buyers. Our processes are accomplished in a closed environment to prevent any leakage, like CFCs, into the environment.

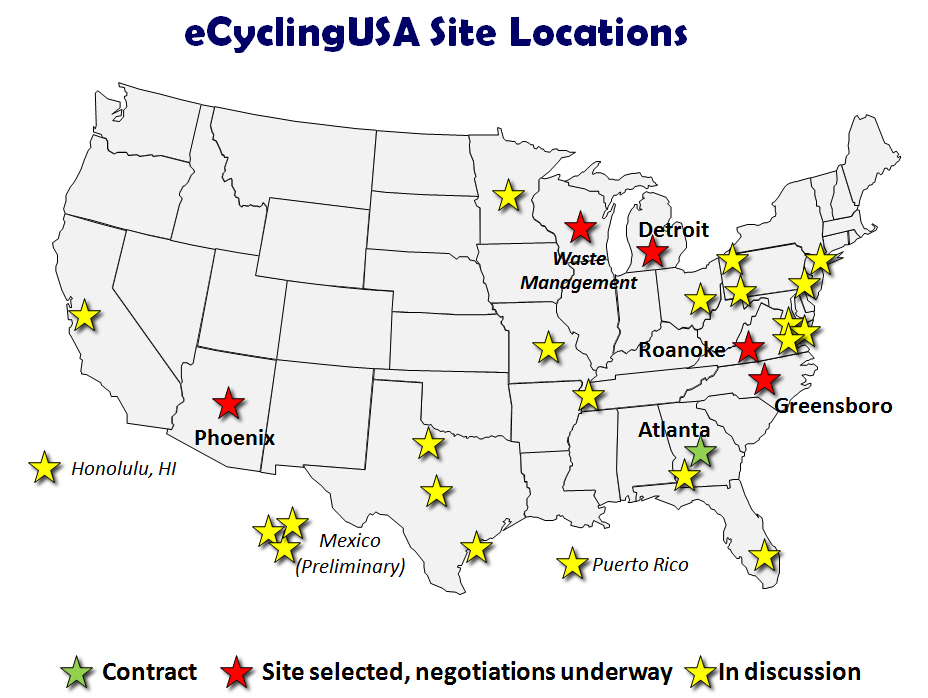

eCyclingUSA signed its first US contract for a 10 ton/hour whiteware, eWaste, whiteware and brownware processing facility in College Park, Georgia, a suburb in the Atlanta metropolitan area. eCyclingUSA is also in negotiation with five other communities and in discussion with two dozen more communities as shown below.

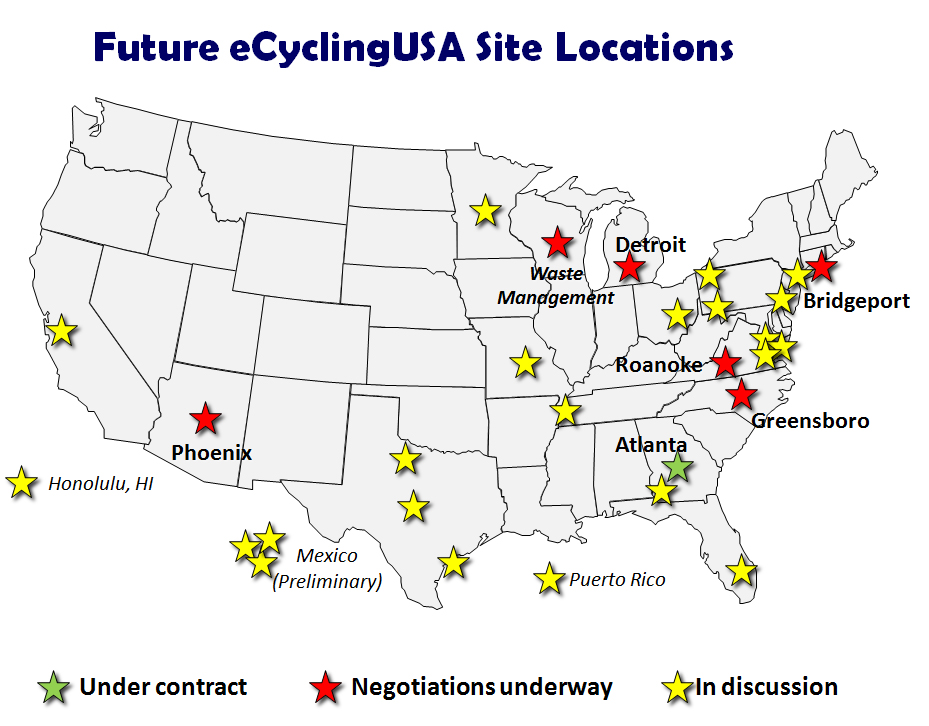

The Jobenomics/eCyclingUSA goal is to implement 50 to 100 electronic waste facilities in the USA by year 2020. In addition, eCyclingUSA has a cryogenic process for producing fine rubber products from scrap tires. Our scrap tire technology will be offered as add-on to the electronic waste facilities.

eCyclingUSA pledges to donate a minimum of 10% of its annual profits to a Jobenomics Business Generator that will mass produce small business in the local community.

In conclusion, every community in America should look to urban mining to (1) recover (waste-to-materials) or convert (waste-to-energy) their waste streams, (2) reduce landfilling and exporting of raw materials, and (3) creating new businesses and jobs.

[1] EPA, Municipal Solid Waste in the United States, 2009 Facts and Figures, Figure ES-5. Number of Landfills in the United States, 1988 - 2009, Page 15, http://www.epa.gov/epawaste/nonhaz/municipal/pubs/msw2009rpt.pdf

[1] US Environment Protection Agency, Electronics Waste Management in the United states Through 2009, published May 2011, http://www.epa.gov/osw/conserve/materials/ecycling/docs/summarybaselinereport2011.pdf

[2] US Environment Protection Agency, Disposing of Appliances Responsibly, http://www.epa.gov/ozone/partnerships/rad/raddisposal_factsheet.html

[3] EPA, Municipal Solid Waste in the United States, 2009 Facts and Figures, Table 12, Page 72, http://www.epa.gov/epawaste/nonhaz/municipal/pubs/msw2009rpt.pdf

[4] EPA, Municipal Solid Waste in the United States, 2009 Facts and Figures, Table 12, Page 72, http://www.epa.gov/epawaste/nonhaz/municipal/pubs/msw2009rpt.pdf

- .

- Scrap Tires. In addition to electronic waste, the USA discards approximately 300 million scrap tires per year. Primary scrap tire markets include: tire-derived fuel, civil engineering, and ground rubber/rubberized asphalt applications. In the US, the primary means of disposal of scrap tires is tire-derive fuel due to their high heating value. The typical selling price for tire-derived fuel is approximately $50/ton Pyrolysis of waste tires generates combustible gases, oil, and char products. Cryogenics processes (in use in Europe) produce fine rubber powders that can sell for as much as $8,000/ton.

America is decades behind Europe in terms of recycling electronic waste (eWaste, whiteware and brownware). Germany and France uses technology to sort, process, shred, segregate and sell raw materials generated by the decomposition of electronic waste. This is not only economically sound but significantly reduces the need for landfilling. As stated earlier, Americans only recycle about 5% of annually produced eWaste not including whiteware and brownware, or the vast quantities in storage and landfills. However, America environment concerns are changing and 25 states have moratoriums on placing electronic waste in landfills. These moratoriums have led to increased exporting as well as domestic recycling. In addition, the number of US landfills have decreased from 7,924 in 1988 to 1,908 in 2009[5]—a decrease of 76% in two decades.

Regarding exporting, over the last year, Jobenomics has met with dozens of US city managers regarding the disposition of electronic waste, landfill conversion and urban mining. Virtually all of the city managers (mayors, city councils, solid waste managers) were unaware that they were foregoing such a lucrative source of revenue and were very interested in how Europeans were monetizing their waste streams. They were also unaware that most of their policies and procedures encouraged exporting electronic waste overseas as opposed to domestic recycling. For example, many government solid waste managers acknowledge that they work with companies whose sole purpose is to identify high-value electronic waste items (computers, refrigerators) for shipment to China. These companies would buy high-value items for pennies on the dollar and use the empty 40 foot containers that the Chinese use to ship their exports to the US to export our high-value materials back to China. The non-high-value items were discarded in local landfills paid by taxpayers.

Regarding domestic recycling, despite the rhetoric, America is in the infancy of recycling compared to Europe. Of the 3,000+ American recycling companies, the vast majority (99%) use manual processes to strip out the highest value materials, like copper, and discard the remaining materials in landfills. Jobenomics estimates that less than 100 recycling companies use advanced processes to de-manufacture or shred electronic waste to obtain raw materials. Most of these companies are niche recyclers that focus on high-value items like cell phones and computer mother boards. Perhaps the leading US recycler is Electronics Recycling International (ERI) that processes over 80,000 tons annually in seven states with collection facilities in all 50 states. ERI’s CEO is credited with creating the term “urban mining”.

Jobenomics believes that companies like ERI are essential to processing the tens of millions of tons of US electronic waste that is increasing every year. Considering the advent of cloud and mobile computing as well as flat panel TVs, this trend will likely continue into the foreseeable future. Since ERI only processes only 3% of the narrowly defined eWaste market, hundreds more companies like ERI will be needed to process the entirety of the electronics waste stream (eWaste, whiteware and brownware) that is produced annually plus the amount in storage (homes, businesses and warehouses) and landfills (both sequestered above ground and buried beneath). In order to meet this massive environmental challenge, Jobenomics also endorses the European model of locally owned and operated micro-processing facilities.

Jobenomics visited European electronic waste processing plants in Germany, France and Poland. As a result of these visits, Jobenomics created a company, called eCyclingUSA (www.eCyclingUSA.com), that is partnered with the leading European manufacturer (CHEMA Environment GmbH, a division of SYSTEC, Germany) of state-of-the-art urban mining systems: MSW sorters, Single Stream Recycling Systems, Electronic Waste Recycling and Rubber Tire Recycling systems. SYSTEC currently designs turnkey plants in use in 60 facilities throughout Europe that produce an annual profit of approximately $30 million per year for their respective communities.

There are no comparable US plants that shred eWaste, whiteware and brownware, and separates the raw materials (copper, aluminum, iron, plastics) in minutes into pellet form.

These pellets/powders are aggregated by raw material type and packaged for sale to commodity buyers. Our processes are accomplished in a closed environment to prevent any leakage, like CFCs, into the environment.

eCyclingUSA signed its first US contract for a 10 ton/hour whiteware, eWaste, whiteware and brownware processing facility in College Park, Georgia, a suburb in the Atlanta metropolitan area. eCyclingUSA is also in negotiation with five other communities and in discussion with two dozen more communities as shown below.

The Jobenomics/eCyclingUSA goal is to implement 50 to 100 electronic waste facilities in the USA by year 2020. In addition, eCyclingUSA has a cryogenic process for producing fine rubber products from scrap tires. Our scrap tire technology will be offered as add-on to the electronic waste facilities.

eCyclingUSA pledges to donate a minimum of 10% of its annual profits to a Jobenomics Business Generator that will mass produce small business in the local community.

In conclusion, every community in America should look to urban mining to (1) recover (waste-to-materials) or convert (waste-to-energy) their waste streams, (2) reduce landfilling and exporting of raw materials, and (3) creating new businesses and jobs.

[1] US Environment Protection Agency, Electronics Waste Management in the United states Through 2009, published May 2011, http://www.epa.gov/osw/conserve/materials/ecycling/docs/summarybaselinereport2011.pdf

[2] US Environment Protection Agency, Disposing of Appliances Responsibly, http://www.epa.gov/ozone/partnerships/rad/raddisposal_factsheet.html

[3] EPA, Municipal Solid Waste in the United States, 2009 Facts and Figures, Table 12, Page 72, http://www.epa.gov/epawaste/nonhaz/municipal/pubs/msw2009rpt.pdf

[4] EPA, Municipal Solid Waste in the United States, 2009 Facts and Figures, Table 12, Page 72, http://www.epa.gov/epawaste/nonhaz/municipal/pubs/msw2009rpt.pdf

[5] EPA, Municipal Solid Waste in the United States, 2009 Facts and Figures, Figure ES-5. Number of Landfills in the United States, 1988 - 2009, Page 15, http://www.epa.gov/epawaste/nonhaz/municipal/pubs/msw2009rpt.pdf