Recent US Employment Trends addressed the three most important employment sectors: private sector service-providing industries, private sector goods-producing industries, and the government sector. This article examines the government sector in more detail and hypothesizes how many more job losses could occur in the near future.

2012 will be a pivotal year for the US economy. For 2012, Jobenomics assesses the following probabilities: 20% chance that the economy will improve, 30% that it will continue to muddle along, and 50% it will get worse depending on the severity of financial disruptions (see 2012 Jobenomics Outlook article). Given this 50/50 forecast, Jobenomics forecasts that the current government trend of government layoffs will continue.

The Jobenomics plan calls for creation of 20 million new private sector jobs with emphasis on small, emerging and self-employed businesses in service-providing industries in order to generate a robust economic recovery. Our plan also calls for zero government growth as opposed to cuts in government employment. However, since the US is creating new jobs at only 45% of what is needed (see Recent US Employment Trends) reductions in the government workforce appear inevitable. A drop of 5.4 million government jobs is our best guess given current economic conditions and trends. It is our hope that these reductions will not occur if the economy improves on its own, or is nudged by the Jobenomics national grassroots movement.

Local Government Civilians: 2 million potential job reductions.

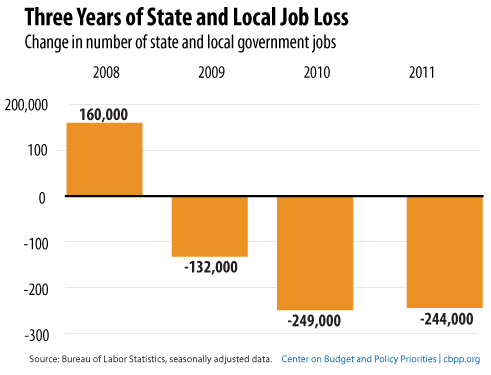

State and local governments have been shedding jobs for the last three years. This trend will likely accelerate and perhaps double from the current rate of 250,000 (see BLS/CBPP chart) to as much as 500,000 layoffs per year. There are four major reasons for this assertion. The first reason deals with decreased discretionary income due to unemployment, under-employment, and declining middle-class wages and net-worth. Decreased discretionary income translates to reduced consumption and lower government tax revenues. Second, federal stimulus funding has ended and new stimulus funding is unlikely. Third, non-essential state, municipal and local programs and services have already been cut. Future cuts are likely to involve personnel. Fourth, reduced property tax revenues will be a major new factor with local governments that are responsible for 82% of all recent government sector layoffs.

State and local governments have been shedding jobs for the last three years. This trend will likely accelerate and perhaps double from the current rate of 250,000 (see BLS/CBPP chart) to as much as 500,000 layoffs per year. There are four major reasons for this assertion. The first reason deals with decreased discretionary income due to unemployment, under-employment, and declining middle-class wages and net-worth. Decreased discretionary income translates to reduced consumption and lower government tax revenues. Second, federal stimulus funding has ended and new stimulus funding is unlikely. Third, non-essential state, municipal and local programs and services have already been cut. Future cuts are likely to involve personnel. Fourth, reduced property tax revenues will be a major new factor with local governments that are responsible for 82% of all recent government sector layoffs.

Property taxes are the main source of tax revenues for municipal and local governments. Because it takes years to process property assessments, the collapse in housing values are just now beginning to impact local governments at a time when federal and state aid are ending. Most local governments predict that their tax base, generated by residential and commercial property taxes, will shrink consistently each year over the next five years.

Since the Great Recession of 2008, when tax revenues from inflated property values and federal/state aid were plentiful, local governments were compelled to shed hundreds of thousands of jobs. Today times are much worse financially. Rainy-day funds have been largely depleted. Cuts in non-essential programs and services mostly have been made. Without a robust US economic recovery, a perfect storm is brewing where local governments may have to make deep cuts in essential services including teachers, police and firefighters. Since education constitutes 56% of local government employment, teachers will be particularity hard hit.

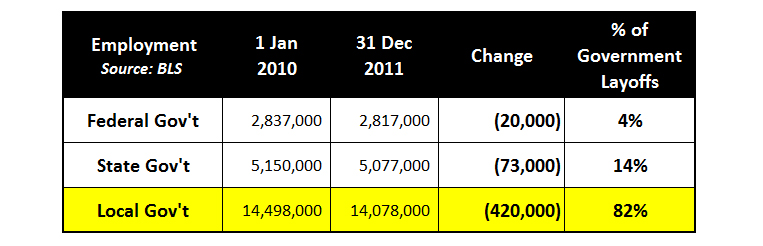

In the last two years, local government jobs decreased from 14,498,000 to 14,078,000, a loss of 420,000 jobs or 1.45% per year. Due to the shrinking tax base, it is likely that this rate could increase to 3%, resulting in 2 million job losses over five years.

In the last two years, local government jobs decreased from 14,498,000 to 14,078,000, a loss of 420,000 jobs or 1.45% per year. Due to the shrinking tax base, it is likely that this rate could increase to 3%, resulting in 2 million job losses over five years.

State Government Civilians: 340,000 potential job reductions. Over the last three years, states had budget shortfalls of $430 billion. State governments rely heavily on sales taxes, income taxes, business taxes, excise taxes and tuitions for state-funded universities. All of these sources of tax revenues are likely to increase, which should keep state layoffs to the minimum. On the other hand, increasing entitlement (Medicaid) and welfare expenses, dwindling federal subsidies, persistently high unemployment rates, and a sluggish economy make balanced budgets a difficult goal for the 42 states that are projecting a $110 billion budget shortfall in 2012.

In the last twelve months, state government jobs decreased from 5,144,000 to 5,073,000, a loss of 71,000 jobs or – 1.4%. While states have the capability of raising many forms of taxes, Jobenomics predicts that voters reject most of the legislative efforts to increase taxes. Without additional tax revenue, states will continue to reduce its public sector workforce. Consequently, it is likely that the -1.4% trend will continue and 340,000 jobs will be lost over the next five years.

Federal Government Civilians: 300,000 potential job reductions. In the last twelve months, federal government employment decreased from 2,844,000 to 2,817,000, a loss of 27,000 jobs or – 0.9%. This modest rate is likely to increase due to budget and deficit concerns. There are growing calls from Congressional conservatives that the US federal government should reduce size by as much as 10%. While opposed, Congressional liberals are faced with a dilemma justifying high federal government salaries in relation to growing needs of the unemployed and other financially challenged groups. Jobenomics predicts that federal civilian workforce reductions (not including the US Postal Service and DoD Civilians) will average 2.5% over the next five years, which would result in 170,000 job losses.

612,000 US Postal Services employees are federal employees. In the last twelve months, the postal service lost 30,700 jobs, or 4.8% of its workforce. Due to inefficiencies within the postal service, private sector competition and increased use of email, this trend is likely to continue at its current rate for a loss of 130,000 jobs in five years.

US Military: 435,000 potential job reductions. The Department of Defense (DoD) is comprised of 1,430,895 active duty, 848,000 reserve, and 779,000 federal civilian employees for a total of 3.1 million personnel. Secretary of Defense Leon Panetta is considering reductions once thought sacrosanct. Planned cuts of $450 billion will reduce the military budget by 7% to 8%. According to Panetta, “Rough estimates suggest after ten years of these cuts, we would have the smallest ground force since 1940, the smallest number of ships since 1915, and the smallest Air Force in its history.” SecDef’s forecast does not include $600 billion of other potential congressionally mandated DoD reductions which could increase DoD cuts to approximately 20%. $600 billion is half of the potential $1.2 trillion sequestration amount.

Priority currently is being placed on cutting weapons programs, but in the end, manpower will have to be reduced since it is the largest component of the national security budget. Due to annual trillion dollar budget deficits, a flagging economy, priority given to mandatory accounts (Social Security, Medicare) over discretionary accounts (National Security), attrition of returning Iraqi and Afghani veterans on top of normal attrition, rising personnel and retirement costs, and inflation, the DoD is a prime target for severe cuts in manpower.

Jobenomics estimates that the US military and civilian workforce is likely to decrease at an annual rate of 3% per year over the next five years. If this occurs, 435,000 positions will be lost.

Government Contractors: 2.3 million potential job reductions. Exact numbers of government contractors are hard to obtain. So Jobenomics accessed data from USAspending.gov which provides the public with information about how their tax dollars are spent. According to USAspending.gov, in fiscal year 2011, the US federal government’s direct payment to federal government civilian contractors was $895 billion. Jobenomics estimates the approximate number of federal contractor employees by dividing their estimated average wage and benefits of $120,000 (triple the median private sector wage, but equal to the average federal government civilian pay) into $895 billion, which equals 7.4 million federal contractor employees. While the number of state and local civilian contractors jobs are unknown, it is safe to assume at least 2.6 million (1/3 of federal contractor jobs), for a total of 10 million government (federal, state, local) civilian employees.

Due the size of budget deficits at all levels of government (federal, state and local), 5% cuts are likely for federal contractors over the next five years, resulting in the loss of 2.3 million jobs.

Cuts of this magnitude would cause a crisis for defense and aerospace industries. While national security enthusiasts will vigorously resist the magnitude of these cuts, similar defense industry cutbacks occurred after WWII, Vietnam, and the Cold War. Cold War spending was replaced by the so-called “Peace Dividend” which reduced military expenditures as a percent of GDP by approximately 50% over ten years. Considering the severity of annual trillion dollar budget deficits, and a potential post-Iraq/Afghanistan peace dividend, it is conceivable that massive defense contractor reductions could occur in a period of five years, if the US economy does not significantly improve soon.

Pingback/Trackback

Stefen Havana

Pingback/Trackback

Mariette Trevithick

Pingback/Trackback

acne

Pingback/Trackback

santos

Jerrold says:

You’re so awesome! I do not think I’ve truly read through something like

that before. So wonderful to discover somebody with original thoughts on this subject matter.

Really.. thanks for starting this up. This website is something that is needed on the internet, someone with a little originality!