Q2 2017 GDP Growth 2.6%

Real gross domestic product (GDP) increased at an annual rate of 2.6% in the second quarter of 2017 (Q2 2017) according to the “advance” estimate released by the U.S. Bureau of Economic Analysis on 28 July 2017. 2.6% is a positive sign for the U.S. economy and a potential pivot point for President Trump’s bold plan to grow GDP to an annual rate of 4%, create 25 million new jobs and get the “American economy back on track”. To understand the nexus between GDP and employment, as well as the efficacy of the Trump Plan, one must understand U.S. GDP growth from a historic and strategic perspective.

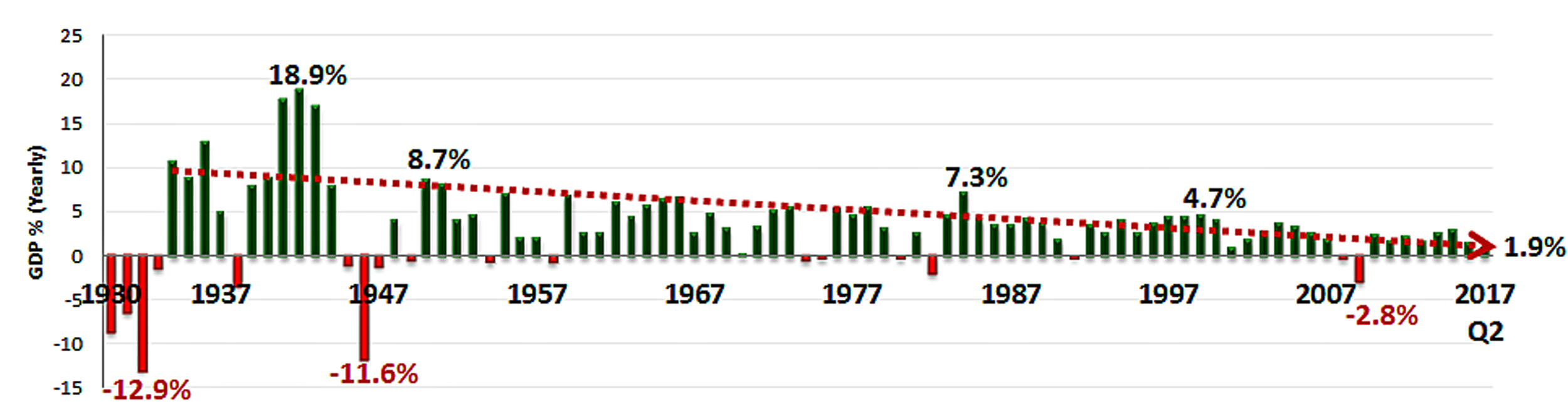

U.S. GDP History, by Year, Since Great Depression

This chart puts U.S. GDP, by year, into perspective since the Great Depression (1929-33). During the early years of the Great Depression, U.S. GDP hit its nadir of -12.9% in 1932—the year that President Franklin D. Roosevelt was elected. During FDR’s first term in office, he instituted the “New Deal” that pumped significant amount of federal government money to revive the economy. During FDR’s second term in office (1937-41), U.S. economy boomed during the buildup and entry into WWII on 7 December 1941 after the attack on Pearl Harbor. In 1942, U.S. GDP hit its all-time high of 18.9%. During the post-WWII period, U.S. GDP slumped to -11.6% due reduced government spending and tepid private sector investment. However by 1950, the U.S. economy was humming again. By 1950, U.S. GDP hit a high of 8.7%. Since 1950, U.S. GDP declined steadily to the current day, surging during periods of war (Korea 1950-53, Vietnam 1960-75) and declining during recessionary periods (1937-38, 1945, 1949, 1953, 1958, 1960-61, 1969-70, 1973-75, 1980, 1981-82, 199-91, 2001 and the Great Recession of 2007-09).

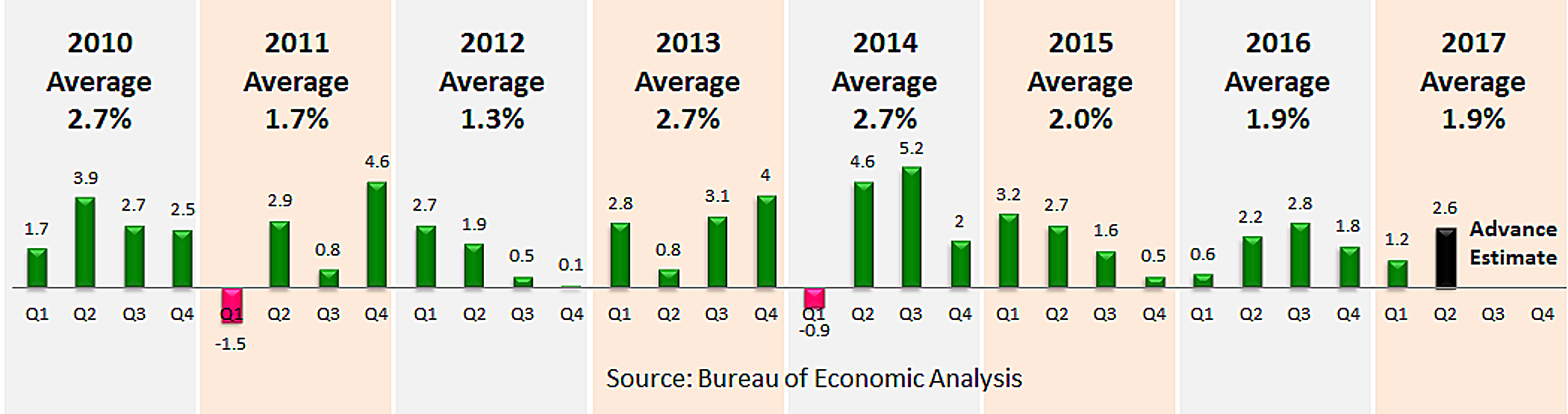

Real GDP Quarterly Percent Change This Decade

BEA, Table 1.1.1. Percent Change From Preceding Period

Most economists believe that economic growth depends on employment and GDP growth. Today, the ideal rate for U.S. GDP growth is around 3%. If GDP growth exceeds 4%, generally signal signs of an overheating economy and asset bubbles. Any GDP growth below 2% is considered sclerotic growth that makes the U.S. economy vulnerable to financial downturns.

According to the Bureau of Economic Analysis (BEA), during the post-recession recovery period from Q1 2010 through Q1 2017, U.S. GDP averaged 2.25%. In 2015 and 2016, U.S. GDP grew by subpar rates of 2.0% and 1.9% respectively. During the six months of the Trump Administration, GDP averaged 1.9%.

Q1 2017’s GDP “revised” estimate (latest) was a subpar 1.2%—up from an abysmal “advance” estimate of 0.7%, equal to the 1.2% “second” estimate, and down from the 1.4% “third” estimate. Regardless of estimate, Q1 GDP data was not good news for the new Trump Administration. However, these low percentages can be rationalized as a carryover from the previous Administration.

Q2 2017’s GDP “advance” estimate (latest) is 2.6%—a significant improvement over Q1 and a good sign for President Trump’s stated goal of raising U.S. GDP growth to 4.0%. In regard to other Q2 2017 prognosticators, the Federal Reserve Bank of Atlanta’s GDPNow forecast model for Q2 2017 is 2.8%, down from a 4.3% forecast on 1 May 2017. It is interesting to note that the Fed’s GDPNow forecast model for Q1 2017 started at a high of 3.1% on 2 February 2017 and decreased steadily to 0.2% by the end of the reporting period. Hopefully, this downward trend will not be repeated for Q2 2017. The “Blue Chip” survey of the bottom 10 and top 10 leading business economists forecast that Q2 2017 growth will eventually fall between 2.3% and 3.2%.

Many economists feel that a recession (two quarters of negative GDP growth) is likely. In January 2016, a Financial Times survey of 51 economists predicted a one-in-five chance of a U.S. recession in the next 12 months. In June 2016, J.P. Morgan Chase economists projected a 36% chance of a U.S. recession in 12 months. In July 2016, Deutsche Bank estimated a 60% chance of the U.S. entering a recession in the next 12 months. In October 2016, Wall Street Journal’s survey of economists placed a 60% likelihood of a U.S. recession within four years. In June 2017, Goldman Sachs gives the United States a 25% chance of a recession with two years. While these projections are only guesstimates, the theme is relatively consistent that sclerotic GDP growth begets recessions. So far the Trump Administration is only averaging 1.9% over its first two quarters.

While GDP growth does not insure employment growth, sclerotic GDP growth discourages business hiring, consumer spending and labor force expansion. Sclerotic GDP growth also discourages lower rates of unemployment and voluntary workforce departures. Negative GDP growth creates recessions and depressions depending on the severity and longevity of the contracting economy. The solution to avoid a financial crisis is to accelerate GDP growth, which requires the creation of more productive private sector jobs, which, in turn, can only be generated by a massive expansion of the small business sector.