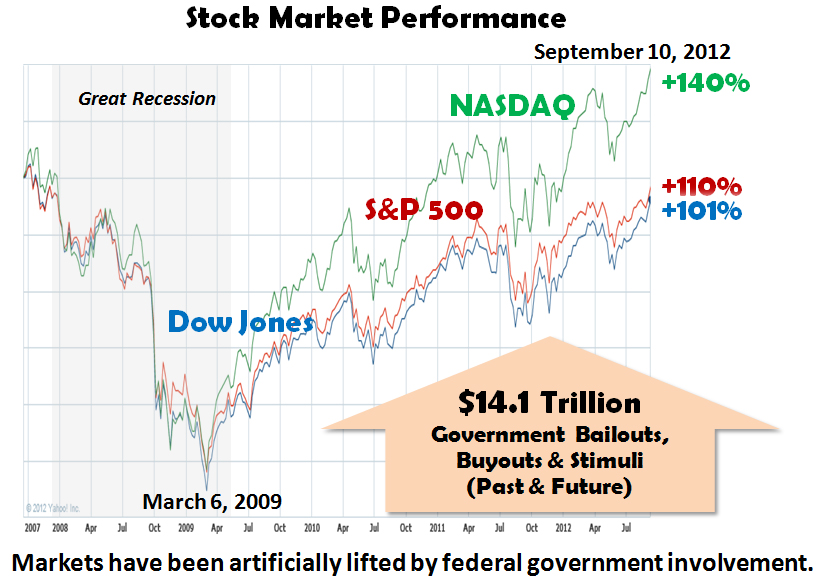

What’s going on? Stock markets are approaching historical highs while the middle-class has lost 40% of its net worth, unemployment is persistently high and the ranks of those “not in the labor force” (i.e., the Bureau of Labor Statistics’ category for those who can work but don’t) is increasing by three million people a year. Government efforts to artificially induce economic recovery explain much of reason that the markets seem to be disconnected from the rest of society.

The Great Recession of 2008/09 was a calamity that could have gotten much worse. Both the Bush and Obama Administrations and the Federal Reserve reacted strongly with stimuli, bailout and buyouts to reverse the downward trend. Thankfully, their efforts worked in regard to the stock markets, which have subsequently risen as much as 140% from their lows in March 2009 (see chart). The US government has committed $14.1 trillion to make this happen and keep the markets growing.

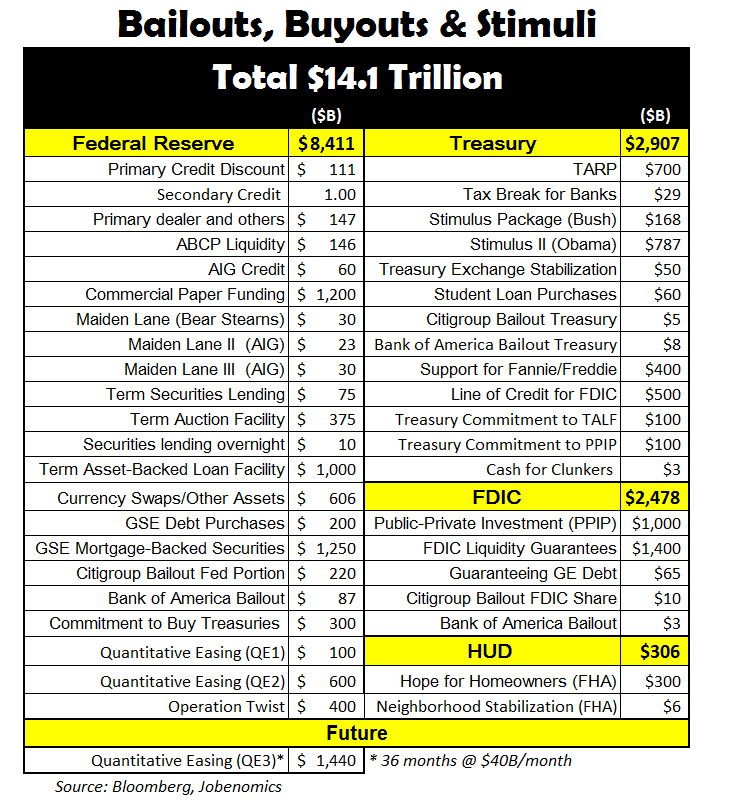

Composition of the $14.1 trillion is shown above. Federal Reserve programs totaled $8.4 trillion, mostly for banks, financial institutions, insurance companies and government sponsored enterprises (Fannie Mae and Freddie Mac—holders of most American mortgages). US Treasury programs totaled $2.9 trillion, mostly to individuals and the auto industry. Federal Deposit Insurance Corporation (FDIC) totaled $2.5 trillion, mostly for local banks. The US Department of Housing and Urban Development (HUD) totaled $0.3 trillion, mostly for homeowners via the Federal Housing Administration (FHA).

From a Jobenomics perspective, these stimuli, bailouts and buyouts have contributed to economic recovery, albeit slow and shaky. However, a number of big questions remain unanswered: (1) how effective are new stimuli, (2) when will stimuli become unaffordable considering government debt, deficits and the value of the US dollar, (3) how will the markets operate without government stimuli, and (4) how will the economy/markets react to the next major disruption? For the purposes of this blog posting, let’s focus on new stimuli (1) and address the other factors in future postings.

Quantitative easing (QE) is a monetary policy used by the Federal Reserve to stimulate the national economy by purchasing financial assets (usually toxic) from banks and private institutions with newly created money. The third round of quantitative easing (QE3) was announced by Chairman Bernanke on 13 September 2012. QE3 is an open-ended (at least to mid 2015) $40 billion per month program to buy the mortgage-backed securities that started the housing crisis and Great Recession. QE3’s goal is to reduce the amount of toxic mortgage-related financial assets from the private sector to spur the residential construction industry that continues to languish today and likely into the future (see Jobenomics’ Construction Industry Forecast).

Jobenomics is a big fan of Chairman Bernanke and considers him the “John Wayne” of our economy (read Jobenomics, the book, to find out why). However, Jobenomics disagrees with him on one major point. Chairman Bernanke believes that the US economy is facing a stiff headwind that will eventually abate and that stimuli are needed until the wind abates. Jobenomics believes that the US economy is structurally flawed when Americans, from Wall Street to Main Street, shifted emphasis from manufacturing and producing to investing and speculating, and seriously needs re-enginnering as opposed to stimuli.

On 4 September 2012, Chairman Bernanke told fellow central bankers “I see little evidence of substantial structural change in recent years… Following every previous US recession since World War II, the unemployment rate has returned close to its pre-recession level.” Consequently, his approach to encouraging economic growth is to rely on past practices and stimulate the economy by printing money, buying and selling treasuries and securities, and keeping interest rates low. He will be able to continue this course until the value of the dollar declines or inflation increases. Considering the turbulence in other developed economies and slowing growth in emerging economies, he may have only months to several years to do so. Europe is on the verge of recession and its contagion is likely to spread to the US.

Not all economists agree with Chairman Bernanke’s optimism. The National Bureau of Economic Research recently published a paper written by Northwestern University’s Robert Gordon that concludes the US growth rate is damaged, and the past 250 years may prove to have been a “unique” period of economic expansion. St. Louis Fed (FRED) President James Bullard says that “the economy was on one trend pre-crisis and is on a very different trend post-crisis.” Other skeptics include Mohamed El-Erian and Bill Gross of Pacific Investment Management Co., who popularized the term “new normal” meaning that economic malaise and high unemployment may be with us for the foreseeable future.

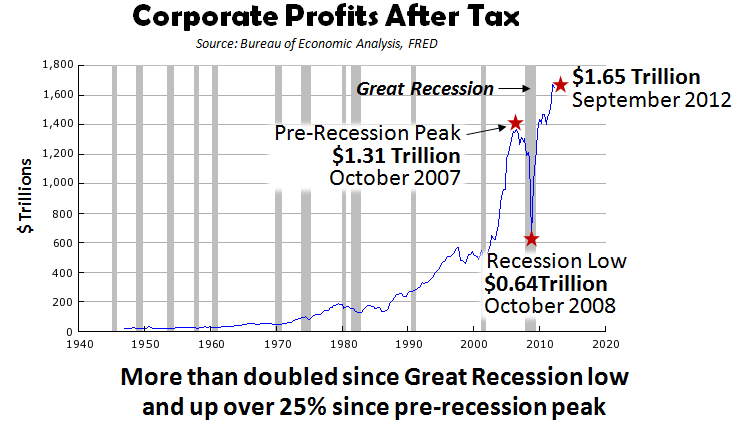

Regardless who is right, everyone agrees that increased profitability in banks, financial institutions and corporations have not translated to improvement in employment and wealth of the average American citizen who has lost 10% in household income and 40% in net worth in recent years.

Corporate profitability has more than doubled since the Great Recession low and is up over 25% since the pre-recession peak as shown above. As of September 2012, corporate-profits-after-tax is at an all time high of $1.65 trillion as reported by the Federal Reserve and Bureau of Economic Analysis. This does not include several trillion more dollars of corporate cash stranded overseas.

Financial institutions and corporations are inextricably linked. Financial institutions make money in a large part by speculating in secondary-markets that are comprised of corporate stocks listed on the major exchanges. The Dow Jones Industrial Average (DOW or DJIA) is comprised of the top 30 publically-traded US corporations. The Standard & Poor’s 500 (S&P 500) is based on the common stock averages of the top 500 American publically-traded companies. The NASDAQ Stock Market (formerly National Association of Securities Dealers Automated Quotations, now simply NASDAQ) specializes in emerging high-technology corporations. On the other hand, many major corporations are deploying their excess cash speculating in secondary-markets and exotic financial instruments (like derivates such as mortgage-backed securities) as opposed to recapitalizing and hiring domestic workers. Consequently, when the US government stimulates, it is the financial institutions, corporations and quasi government agencies (like Fannie and Freddy) that benefit the most.

If Chairman Bernanke and his backers are correct that economic malaise and chronic unemployment are due to a strong, but temporary headwinds, financial institutions and corporations should lead the way to economic recovery. However, there are signs that this may not be correct.

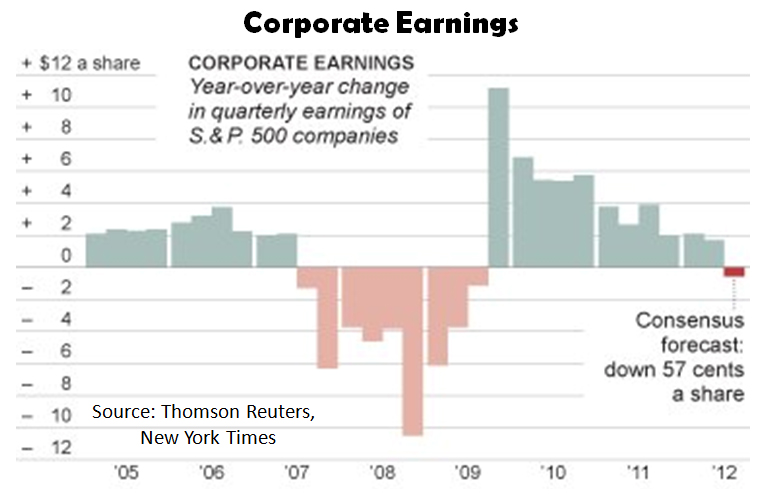

On 9 September 2012, this graph was posted in The New York Times [1]. It shows the year-over-year change in corporate earnings of the top 500 US corporations. Since the initial influx of bailouts, buyouts and stimuli, corporate earnings have decreased every year. According to Thomson Reuters (the world’s leading source of intelligent information for businesses and professionals [2]) and The New Times, the consensus forecast is that corporate earnings will go negative for the first time since the Great Recession. In other words, Americans are getting fewer bangs for the buck with government intervention. In addition, if the corporate world goes into recession, the entire US may not be far behind. The US averages 1.7 recessions per decade. So far this decade has not suffered a recession largely due to the $14.1 trillion worth of stimuli. This time QE3 may not produce it desired effort and the US is rapidly running out of big stimulus funds.

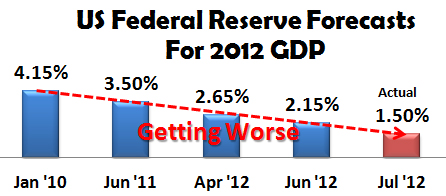

This chart shows that the Federal Reserve’s crystal ball may not be as good as one would hope. In January 2010, the Fed predicted that the stimuli would boost the economy to annual GDP (gross domestic product, the sum of all American goods and services) to 4.15%. Since then it has been consistently revised downward.

Uncle Sam’s bailouts, buyouts and stimuli can be compared to a “sugar high”—lots of temporary energy but no real nutritional value. To grow an economy, a nation needs three essential factors: (1) sound monetary policy, (2) sound fiscal policy, and (3) private sector growth. The Fed is responsible for monetary policy. Under Chairman Bernanke’s leadership, the Fed has done an admirable job by stimulating via controlling (increasing) increasing money supply, borrowing via selling treasuries, reducing toxic financial instruments and keeping interest rates low. However, the Fed cannot produce economic growth, it can only stimulate and incentivize. Congress is responsible for fiscal policy. Their failure to resolve debts and deficits, taxation and budgeting, as well as a host of other economic and employment issues are major obstacles to recovery. The private sector is responsible for growth. Since the beginning of this decade, big business has added only 5% of all new jobs. Small business has added 95%. Unfortunately, big business gets the bulwark of government financing and small business gets a lot of rhetoric. Unless we provide real nutrition (sponsorship, incentives and patient capital) for small, emerging and self-employed business creation, the Uncle Sugar High will create economic malnutrition and unemployment obesity.

[1] http://www.nytimes.com/2012/09/17/business/earnings-outlook-in-us-dims-as-global-economy-slows.html?nl=todaysheadlines&emc=edit_th_20120917

[2] http://thomsonreuters.com/about/

Florine says:

I am glad that you just decided to shed some light on this topic that lots

of people stay away from. It requires an educated

person to become in a position to write an correct article like this.

Extremely good job.Do you’ve other articles like this?

los angeles says:

I’ve to say that you juѕt guys have an excellent

blog here. I like how you create extra as an author than as a

philosopher or someone who just complains.