Download PDF Version: Stock Market and The Fed 1 July 2013

1 July 2013

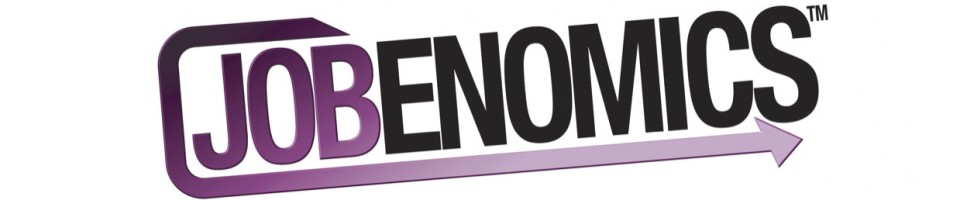

US stock market performance has been phenomenal since the depths of the Great Recession. Since March 2009, all three major US indices (Dow Jones, S&P 500 and NASDAQ) have experienced a 4 ½ year bull market as shown below—up as high as 163%.

The big questions facing economists, policy-makers, opinion-leaders and investors are whether (1) this bull market will continue, (2) can the stock markets operate under their own power, and (3) how chaotic will the markets become during tapering of US government subsidies to big business? To answer these questions, one must first consider the level of involvement of the US government, especially the actions of the US Federal Reserve Board—the single most important government agency in relation to stock markets.

The US Federal Reserve System’s, also known as the Federal Reserve or simply the Fed, engagement on monetary and credit policy has immediate consequences for financial institutions, investors and economic recovery. After 4 ½ year’s of aggressive engagement via printing money, buying securities and manipulating interest rates, an increasing number of investors fear that disengagement by the Fed may have dire consequences regarding the attractiveness of stocks vis-à-vis other investment opportunities, such as commodities, bonds or even cash. Moreover, many economists fear that stock market has been artificially inflated by government involvement and any tapering by the Fed likely to cause the stock market bubble to deflate, or burst, not only in the US but in fragile economies in Europe and Japan. Finally, policy-makers and strategic planners are worried that adverse consequences created by Fed cutbacks will have a domino effect on the global geo-political/economic balance of power.

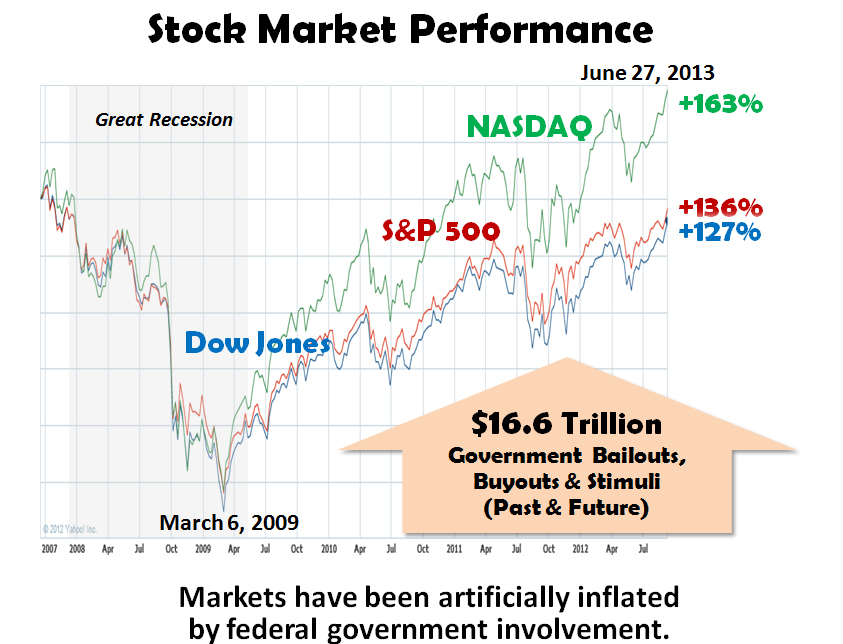

The US government has been stimulating publically-traded financial institutions and corporations to the tune of $16.6 trillion since 2008. Federal Reserve programs totaled $10.9 trillion, mostly for banks, financial institutions, insurance companies and government sponsored enterprises (Fannie Mae and Freddie Mac—holders of 77% of all American mortgages). US Treasury programs totaled $2.9 trillion, mostly to individuals and the auto industry. Federal Deposit Insurance Corporation (FDIC) totaled $2.5 trillion, mostly for local banks. The US Department of Housing and Urban Development (HUD) totaled $306 million, mostly for homeowners via the Federal Housing Administration. Since the Federal Reserve is responsible for 66% ($10.9 trillion out of $16.6 trillion), it has been the most influential organization in regard to the US economic recovery as well as 4 ½ year bull stock market run. Consequently, it is important to understand the role of the Fed and its actions in order to anticipate the future of the US stock markets.

The US Federal Reserve System is the central banking system of the United States. The Fed is both the US government’s bank and the bankers’ bank. As an independent institution, the Federal Reserve System has the authority to act on its own without prior approval from Congress or the President. The Fed was created by Congress to be self-financed and is not subject to the congressional budgetary process. In this way, the Fed is considered to be “independent within government.”

The Federal Reserve System has a number of layers. The top layer is the 7-member Board of Governors, who are appointed by the President and confirmed by the US Senate. Ben Bernanke is the current Chairman of the Board whose term expires on 31 January 2014. The second layer is comprised of 12 regional Federal Reserve Bank districts, each with a board of nine directors, 3 of whom are appointed by the Fed’s Board of Governors and 6 are elected by commercial banks in the district. The third layer consists of approximately 4,900 member banks that are private institutions (mainly national and state-chartered banks). Each member bank is required to subscribe to non-tradable stock in its regional Federal Reserve Bank, entitling them to receive a 6% annual dividend. While not officially part of the Fed, the Federal Deposit Insurance Corporation is a sister institution with 9,500 members. The FDIC-insured lending institutions comprise the vast majority of all bank deposits in the US. A very small number of small banks are neither an FDIC nor a Fed-member bank.

The primary responsibility of the Fed is the formulation of monetary and credit policy in pursuit of maximum employment, stable prices, moderate long-term interest rates, and economic growth. The Fed normally accomplishes this by setting interest rates, controlling the money supply by printing money and trading government securities, and regulating the amount of reserves held by banks.

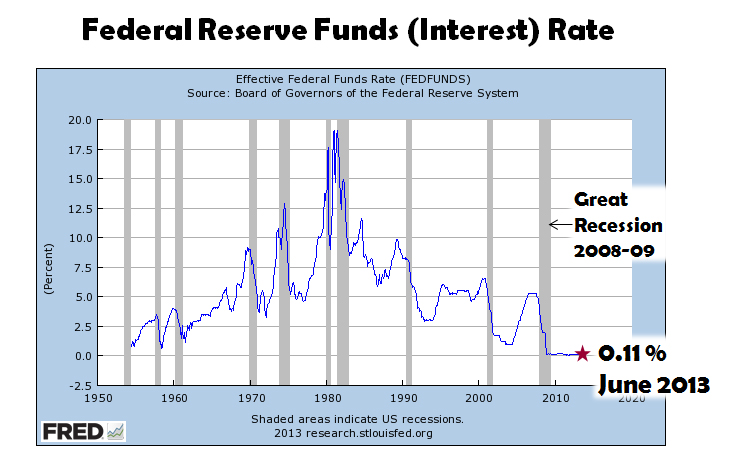

One of the first actions that the Fed initiated was lowering interest rates to almost zero to simulate the economy. As shown above, the Fed lowered the Federal Fund Rate to near-zero prior the end of the recession—the lowest rate in 60 years. Today, four and half years later, this rate remains at near-zero (0.11%). To understand the role that the Federal Funds Rate plays in the banking system, one must first understand the four layers of interest.

- Federal Funds Rate. The federal funds rate (currently 0.11%) is the rate of interest at which federal funds are traded among banks, pegged by the Federal Reserve through its Open Market Operations.

- Federal Reserve Discount Rate. The discount rate (currently 0.75%) is the rate that the Fed charges its depository banks and thrifts who need to borrow money from the Fed. The Fed directly sets the discount rate based on the economic/monetary policy it wants to achieve, as well as the underlying rates that banks charge one another.

- Prime Rate. The prime rate (currently 3.25%) is the interest rate offered by banks to their most valued customers. The prime rate is based on the discount rate.

- Bank Rate. Most consumers are familiar with the interest at their local bank when they apply for a mortgage, auto or other loan. The bank rate (currently 4% to 6%) is based on the prime rate.

Consequently, the Federal Funds Rate sets the baseline interest rate that all other rates are based upon. Since virtually every US bank sets its rates on underlying Fed rates, the magnitude of the Fed’s near-zero rate policy is profound. Unfortunately this near-zero rate has not produced a robust US economic recovery as anticipated. While stocks and corporate profits have soared, GDP growth, employment and lending have languished with dire impact on the American middle class.

When a near-zero Federal Funds Rate does not achieve the desired monetary effect (stimulating economic growth), the Fed turns to other measures since they are not able to reduce interest rates below zero. Normally, the Fed stays out of the private sector, but these are not normal times. As a result of the 2008-09 economic crisis, the Fed was compelled to enter the private sector in essentially three ways:

- Printing money to increase liquidity to increase lending by banks,

- Rescuing too-big-to-fail financial institutions, and

- Buying mortgage-backed securities that are toxic to banks, major financial institutions and insurance companies.

After September 2008, the Fed launched a massive liquidity effort by pouring trillions of dollars in short-term lending into financial firms and corporations. A host of new programs was created, including repurchase agreements, term auction credits, commercial paper funding facility, liquidity swaps and various other loans and bailouts. This liquidity effort was designed to be temporary in nature with a minimum risk to inflation. The liquidity effort worked. It saved a number of banks and corporations (such as the automotive industry) from insolvency without creating inflation. This liquidity, coupled with near-zero interest rates, has also found its way into the US stock markets, which have now recovered their losses since the Great Recession.

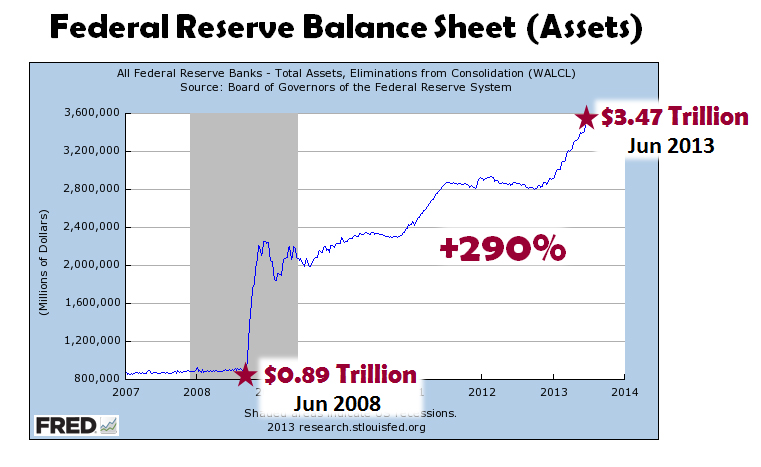

Since 2008 to today, the Fed has purchased approximately $3.5 trillion in toxic financial instruments from the private sector. In essence, the Fed is now carrying the bad debt that formerly resided on the balance sheets of major financial institutions and corporations.

The Fed also launched an aggressive asset purchase program, called quantitative easing or QE. Quantitative easing involves buying securities, which increases the money supply, which promotes increased liquidity and lending. Over time, the Fed’s purchases of these assets was supposed to promote new business investment that, in turn, would bolster economic activity, create new jobs, and reduce the unemployment rate. While QE has bolstered the stock markets, it has done little for business investment or unemployment.

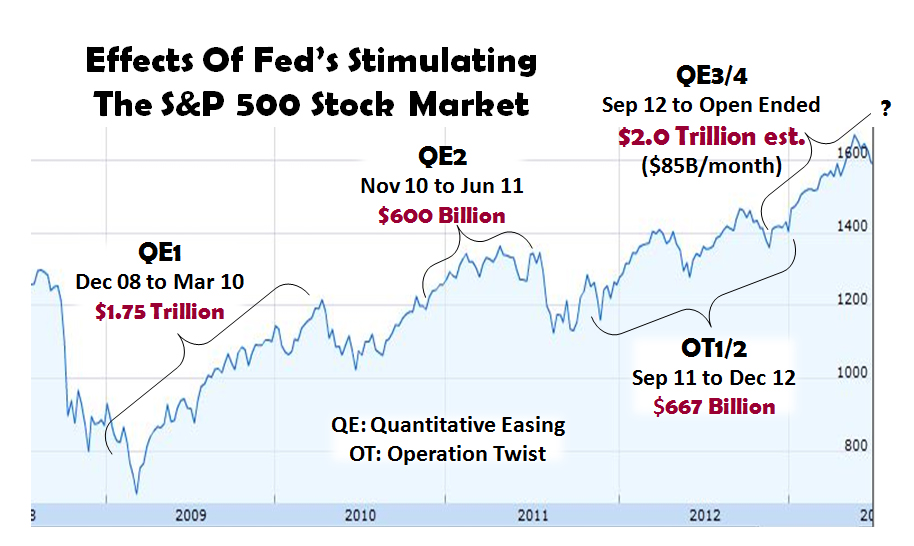

The effect of the Fed’s quantitative easing programs can be seen on the performance of the S&P 500 stock market, which is comprised of America’s top 500 publically-traded companies. As shown on the graph above, every time the Fed initiated a quantitative easing program the S&P 500 grew significantly. The opposite effect happened when the quantitative easing programs ended—the markets declined. The same effects happened with other US and foreign stock markets.

- QE1 (Quantitative Easing #1) occurred between December 2008 and March 2010 and involved a total of $1.75 trillion dollars worth of purchases of toxic mortgage-backed securities ($1.25 trillion) and debt ($200 billion) from Fannie Mae, Freddie Mac, Ginnie Mae and the Federal Home Loan Banks, and $300 billion of long-term Treasury securities. The main purpose was to support the housing market, which was devastated by the subprime mortgage crisis.

- QE2 (Quantitative Easing #2) occurred between November 2010 and June 2011 and involved $600 billion dollars worth of purchases of long-term Treasuries at a rate of $75 billion per month. Treasuries include treasury bonds, notes, and bills. The Fed buys treasury securities when it wants to increase the flow of money and credit, and sells when it wants to reduce the flow. In essence, after the Fed purchases treasury securities, it adds a credit to member banks, which increases the amount of money in the banking system and ultimately stimulates the economy by increasing business and consumer spending because banks have more money to lend at lowered interest rates.

- QT1/2 (Operation Twist #1 & #2) occurred between September 2011 to December 2012 and involved a total of $667 billion. Operation Twist was a plan to purchase bonds with maturities of 6 to 30 years and to sell bonds with maturities less than 3 years, which pressured the long-term bond yields downward and extended the average maturity of the Fed’s own portfolio.

- QE3/4 (Quantitative Easing #3/#4) started in September 2012 and continues today open-ended until the economy recovers and the official employment rate drops below 7%. QE3 provided for an open-ended commitment to purchase $40 billion agency mortgage-backed securities per month until the labor market improves “substantially”. QE4 authorized up to $40 billion worth of agency mortgage-backed securities per month, and $45 billion worth of longer-term Treasury securities.

This graph shows the relationship between the Dow Jones Industrial Average (top 30 US publically-traded companies) and the Federal Reserve’s balance sheet. The Fed’s purchase of toxic mortgage-backed securities from the private sector and Treasuries has bolstered stock markets worldwide, as well boosting US corporate profits to an all-time high as shown below.

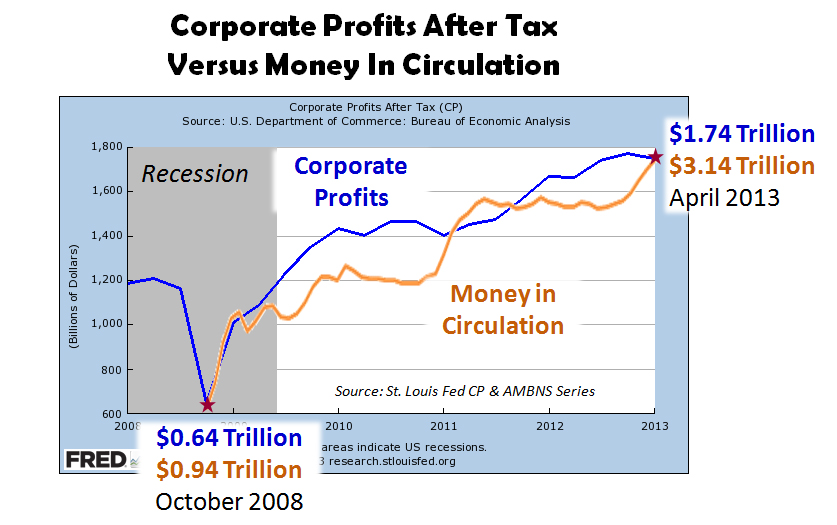

Corporate profitability can be directly tied to the Fed’s involvement. First, low interest rates encouraged investors to buys stocks as opposed to traditional investments like savings accounts, certificates of deposits (CDs) and money market accounts since their rate of return was low due to low Federal rates. Secondly, corporate bonds (even those rated as junk bonds status) offering meager dividends (compared to savings, CDs and money markets) sold briskly allowing corporations to build up their cash reserves and profitability. Rather than hiring or recapitalizing, many corporations used this cash for mergers, acquisitions and buy-backs of their own shares that increased their own net worth as well as their investors. In most cases, these corporate actions were wise financially. Corporate officials knew that the “era of easy money” stimulated by the Fed would eventually end, and building up cash reserves was fiscally responsible until the US economy showed real signs of recovery, which has not happened.

What do we mean by the “era of easy money”? The above chart is an exploded view of corporate profitability from 2008 to today (April 2013) that is overlaid by money in circulation that is controlled by the Fed. During the period, corporate profits rose by $1.1 trillion versus a $2.2 trillion rise in money in circulation. While rising about half the rate of the money supply, corporate profits generally followed the same upward path. This generous supply of easy money allowed corporations to borrow at low interest rates for mergers, acquisitions and buy-backs. In addition, easy money depressed the value of the US dollar relative to other currencies, which made US exports (the domain of big business) more competitive.

The old adage “make hay while the sun shines” is applicable to corporations and their investors in the stock markets. The Fed Chairman has recently indicated that the era of low interest rates, excessive borrowing and quantitative easing are about to end. In other words, the era of easy money is about over and the markets will have to operate with less and less government subsidies. It is clear that the stock markets are addicted to these subsidies and are adverse to any withdrawal. On 20 June 2013, the Dow Jones and the S&P 500 had their biggest point losses in more than a year and a half after Federal Reserve Chairman Ben Bernanke hinted that the Fed could begin dialing back its economic stimulus later this year. After 4 1/2 years of Fed’s quantitative easing levitating stock markets and low interest rates, many investors are terrified by the prospect of market chaos without the underwriting of the Fed.

The probability of market chaos is a given. However, there are two views. The view that is held by most economists, policy-makers and opinion-leaders is that the markets will undergo a period of turbulence but will recover due to structural soundness and historical precedent. Jobenomics takes the opposite view. Jobenomics asserts that the US economy is structurally flawed because Americans, from Wall Street to Main Street, shifted emphasis from manufacturing and producing to investing and speculating over the last three decades. Three decades ago, the US was the largest creditor nation in the world and commanded the lion’s share of global GDP. Today, we are the largest creditor nation in the world and our share of GDP has diminished significantly—largely due emerging economies like China. Jobenomics also asserts that the $16.6 trillion spent by the federal government was not well spent as evidenced by the low rate of US GDP growth, high unemployment, exponential growth of people leaving the US labor force, our dwindling middle class, and a hundred million US citizens dependent on government handouts and welfare payments.

To grow an economy, a nation needs three essential factors: (1) sound monetary policy, (2) sound fiscal policy, and (3) private sector growth. The Fed is responsible for monetary policy. Under Chairman Bernanke’s leadership, the Fed has done an admirable job by keeping our economy from going over the proverbial fiscal cliff. However, the Fed cannot produce economic growth, it can only stimulate and incentivize. Congress is responsible for fiscal policy. Their failure to resolve debts and deficits, taxation and budgeting, as well as a host of other economic and employment issues are major obstacles to economic growth. Private sector businesses are ultimately responsible for economic growth. Unfortunately in this era of big government, private sector businesses have suffered. Moreover, many Americans and politicians view businesses as a necessary evil or as a check book for social programs. Until these negative attitudes change, American economic recovery will be tentative at best.

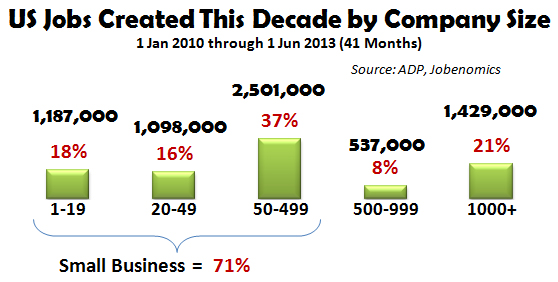

Jobenomics believes that the best prescription for economic prosperity lies with small business creation with emphasis on startup, emerging and self-employed businesses.

Since the beginning of this decade, small business produced 71% of all new jobs. This is an amazing statistic considering the adverse lending environment by financial institutions, mounting government regulation, and the pittance of federal government spending on small businesses. Equally important, is the lack of commercial lending to very small and startup businesses that have been starved for capital. Very small and startup businesses have traditionally been the primary source of employment for entry-level workers and the long-term unemployed. Had the US government paid more attention to small business rather than providing generous subsidies to big business, Jobenomics estimates that ten million more Americans would be employed today if government focused on key next-generation business initiatives. Jobenomics is working on three next-generation business initiatives that could potentially ten million new jobs. These initiatives include: (1) a national effort for Generation Y to monetize social networks via a modernized info-structure, (2) a national direct-care effort to accommodate the aging and children via substantially increasing the number of women-owned businesses, and (3) a national effort to monetize waste streams via waste-to-energy and waste-to-raw materials that could rejuvenate depressed inner cities and the financially disadvantaged.

In conclusion, stock market success may be more of an illusion than reality. At some point in time, US federal government subsidies to financial institutions and corporations will end. When that time happens, we will find out if the markets can operate under their own power. Until then, America needs to diversify its investment strategy starting with small business, the engine of the US economy. Now is an ideal time to implement a new investment strategy to replace the old one that Chairman Bernanke says is about to end.