Jobenomics predicts that 2012 will be a tough year for the US economy, unemployment, and business/jobs creation. The biggest bright spot is small business which, contrary to popular opinion, is now the engine of the American economy as discussed in an earlier Jobenomics article entitled, Small Business: The New “Big Dog”.

US Economy. From a Jobenomics perspective, there are three US economic scenarios: V, W, L (see: Economic Recovery Scenarios article). A V-shaped recovery occurs when the market rebounds after hitting bottom, and returns to its previous high. Eight out of nine US recoveries after a recession have been V-shaped. A W-shaped recovery, also known as a double-dip, happens when the economy rebounds, retreats, and rebounds again. W-shaped scenarios happened during the Great Depression and in the 1975 and 1982 era. An L-shaped recovery indicates a stagnant economy whereas a declining-L symbolizes a declining economy. Japan is undergoing a declining-L scenario for the last two decades. European economies in Greece, Portugal, Spain and Italy are declining to the point of potential economic collapse. As far as America, Jobenomics believes that an equal case can be made for each scenario and that the US economy could take very different paths depending on the American entrepreneurial spirit, leadership decisions, and how our country navigates future disruptions and crises.

2012 will be a pivotal year for the US economy. For 2012, Jobenomics assesses the following probabilities: 20% chance that the economy will improve, 30% that it will continue to muddle along, and 50% it will get worse, or perhaps much worse, depending on the severity of financial disruptions.

Our weakened economic situation makes America vulnerable. The past two years have been relatively free of major disruptions, which allowed our economy to grow, albeit very slowly. If a major event or multiple cascading events happen, a severe recession or a depression is plausible. Potential internal disruptions include: debt or deficit crisis at all levels of government, energy crisis, a wave of strategic defaults in the housing sector, unrest due to unemployment, as well as known and potential unknown “black swan” events, like 9/11. As far as external disruptions, the US economy is far more interdependent and vulnerable to foreign financial crises and conflicts than any time in recent history. Eurozone crisis, Iranian crisis, new wars and conflicts, terrorism and cyber attacks are all possible foreign disrupters.

Unemployment. Jobenomics predicts that the “functional” unemployment rate of 35%, or 111 million US citizens who unemployed/underemployed/no longer looking will continue to rise as the middle-class erodes and the jobless exhaust their unemployment benefits and join those “not in the labor force” (see: 35% “Functionally” Unemployed Rate article). The “official” (U3) unemployment rate will likely increase to the 9% to 9.5% range, or even exceed 10% if a major financial disruption occurs. The primary reason for seeing unemployment increase rather decrease is due to America’s preoccupation with symptoms rather than the cure. Unemployment is a symptom. Employment, via business/job creation is the cure.

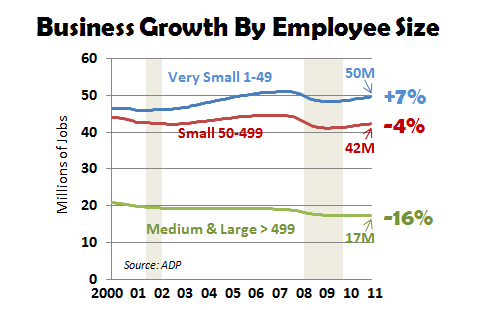

Business/Jobs creation. Jobenomics predicts that America will continue to produce only half of the jobs needed (see: Recent US Employment Trends) since it is preoccupied with top-down government and big business solutions. Since January 2010, small business is responsible for 99% of all new jobs created in the US (see: Small Business Produces 99% of Jobs). The US government sector will lose 3% of its workforce per year over the next five years for a total of 5.4 million lost jobs (see: 5 Million Government Layoffs Ahead?). US good-producing industries, dominated by large manufacturing and construction firms, may stabilize from their precipitous decline in recent years, but will produce few, if any, new private sector jobs in the near future (see: Manufacturing/Construction Forecast).

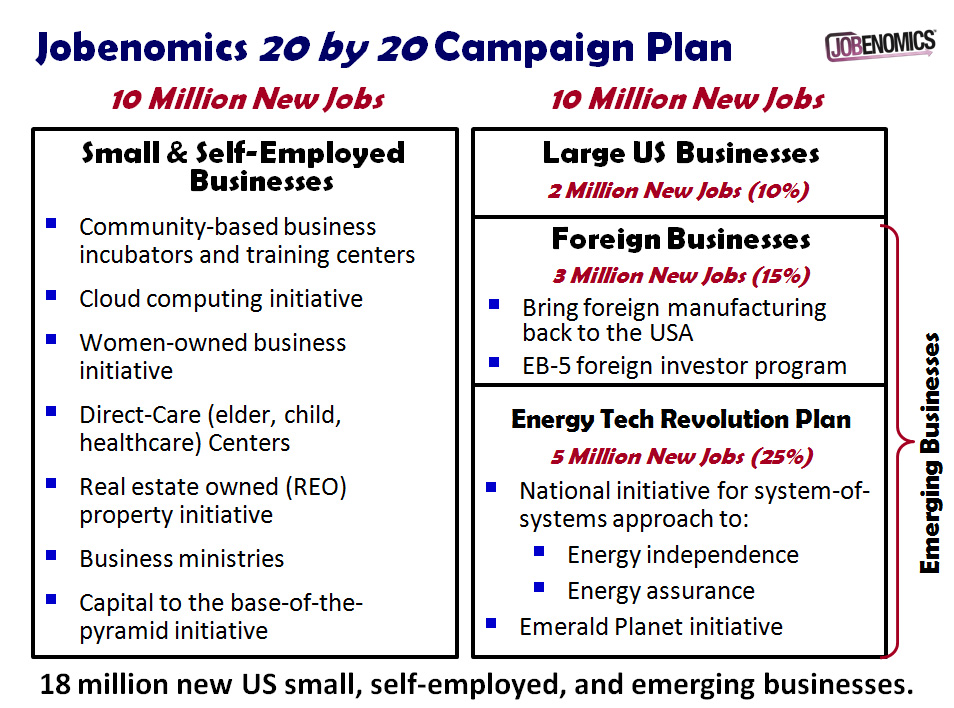

Engaging the American entrepreneurial spirit will be paramount to economic recovery regardless of scenario or outlook. The Jobenomics 20 by 20 Campaign plan calls for 20 million new private sector jobs by year 2020. 18 million are generated by small, emerging and self-employed businesses, 2 million from large US businesses, and zero growth in US federal, state and local government employment. Jobs creation will be dominated by the private sector service-providing industries that are dominated by small business.

Core to the Jobenomics concept is business creation with emphasis on small, emerging and self-employed businesses that are the engine of the US economy and principal employer of 70% of all American workers. To achieve the Jobenomics’ goal of 20 million new jobs by 2020, America needs to redirect its focus from government and big business solutions to small enterprise growth. As shown below, since the beginning of this decade, very small business (1-49 employees) have consistently produced the most jobs and weathered two recessions as well as small, medium and large businesses.