The so-called “fiscal cliff” generally refers to the major fiscal events that may happen in January 2013. These events include expiration of the Bush era tax cuts, the payroll tax cut, other important tax-relief provisions, the sequestration of the ten-year $1.2 trillion cuts of domestic and defense programs required under the bipartisan deficit reduction agreement, and reaching of the national debt ceiling. Without a satisfactory resolution of these issues, the shock to US economy is likely to push America back into recession.

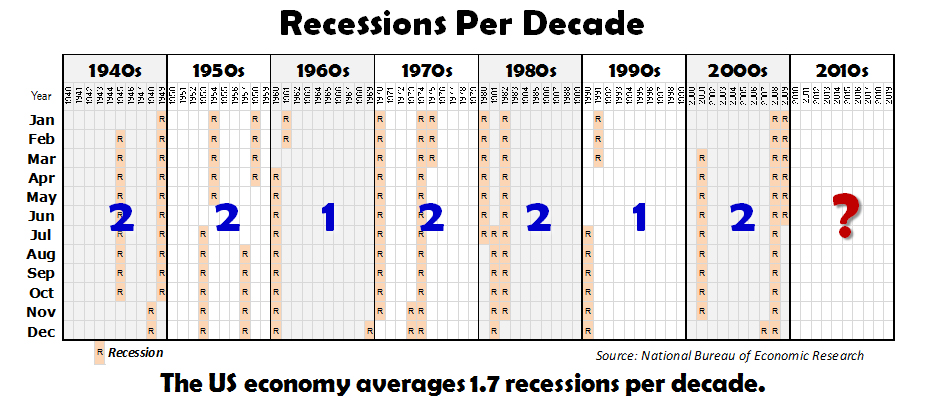

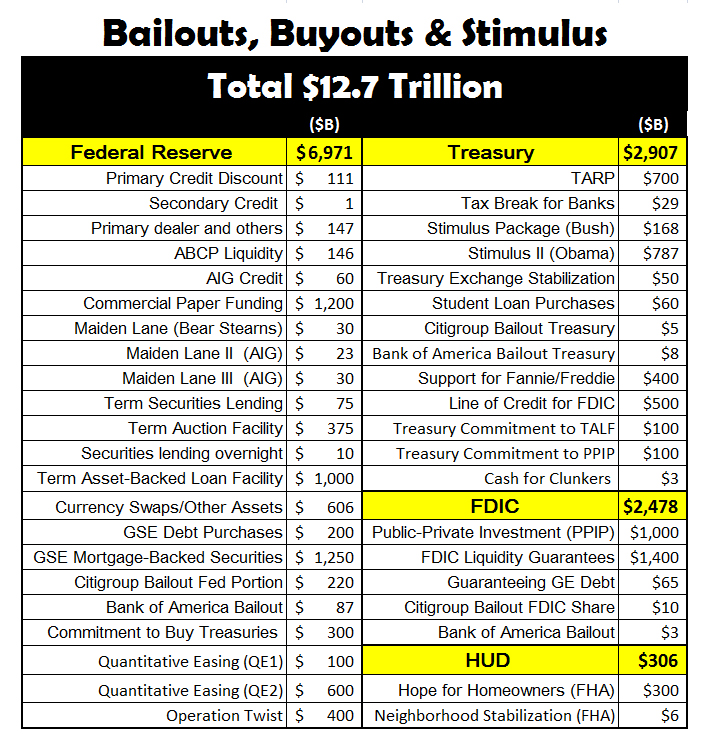

The US economy averages 1.7 recessions per decade. We are now almost three years into this decade without a recession. From a Jobenomics perspective, the reason is relatively straight forward. The US federal government has injected $12.7 trillion dollars worth of bailouts, buyouts, stimulus (shown below) into the US economy since the end of the Great Recession in 2009 in an effort to induce economic recovery.

In addition to the $12.7 trillion, the Federal Reserve took the unprecedented move of lowering interest rates on money lent directly to banks to near-zero, hoping to revitalize the economy. These efforts of “going big” have indeed spurred a modest but fragile recovery. However, these bold efforts have not produced the kind of results that the federal government and American public expected.

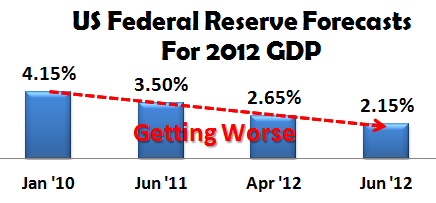

In January 2010, the Federal Reserve forecast that the annual US Gross Domestic Product (the monetary value of all finished goods and services produced in America) growth rate would be 4.15% in year 2012 (today). This forecast was revised downward in June 2011, April 2012 and again in June 2012 to 2.15%. Consequently, the Federal Reserve, the organization in charge of US monetary policy, believes that the US economy is getting worse. It was the Federal Reserve Chairman, Ben Bernanke, himself who recently coined the term “fiscal cliff”. In his semi-annual monetary and economic report before the Senate Banking Committee on 17 July 2012, Chairman Bernanke stressed that Congress (the organization in charge of fiscal policy) to find a solution the impending fiscal cliff without harming the “fragility of the recovery”.

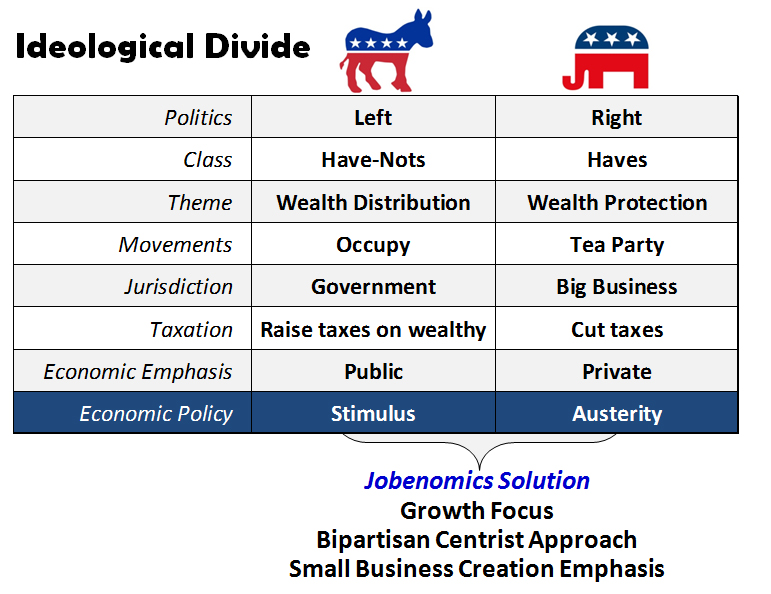

Monetary policy generally involves setting interest rates and money supply by the central bank (Federal Reserve) while fiscal policy involves generally spending and taxes by the legislature (Congress). Jobenomics has been and currently is supportive of monetary policies the low-key and often controversial Ben Bernanke. America would be worse off without him. Jobenomics is not so generous with Congress, which is deadlocked in an acrimonious ideological divide.

It is unlikely that the US Congress will be able to find a solution the impending fiscal cliff due to the ideological divide between the politics of the left and right. Each side is ideologically entrenched in their beliefs with little room for compromise. From a Jobenomics perspective, a combination of selected government stimulus and austerity programs is needed in the near-term to avoid the approaching fiscal cliff. However, this is a short-term fix. Government cannot create sustainable jobs. Only businesses can create careers, professions and jobs that last over time. Consequently, Washington’s focus needs to be on business creation, not job creation.

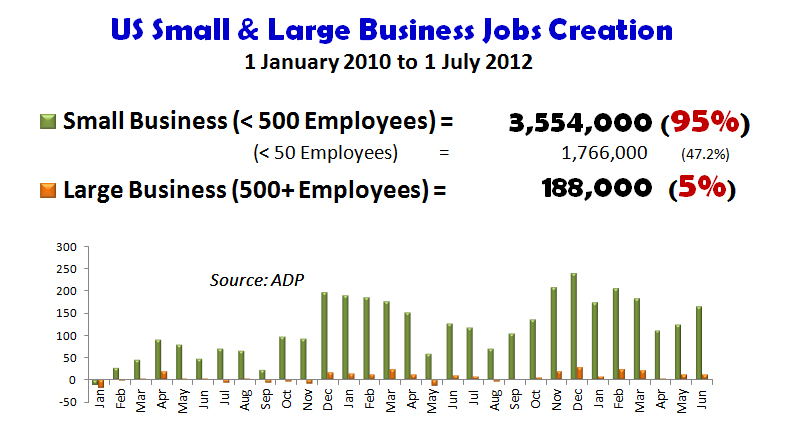

Small business has been responsible for 95% of all new jobs created this decade (see Jobenomics Employment Scoreboard – July 2012 posting). Big business created only 5%. Despite all the rhetoric, neither candidate for president nor the members of Congress have produced a viable small business growth plan. What is really needed is emphasis on small, emerging and self-employed business growth—growth that depends on motivating and financing the base of America’s economic pyramid.

Even with a viable small business growth plan, the US has to over a number of potential disruptive forces that portend to upend our economy. As discussed, the biggest problem facing the US economy is the lack of leadership. Those responsible for fiscal policy need to accommodate a common vision. The next highest priority involves fixing the national debt crisis that could bankrupt our country by the end of this decade.

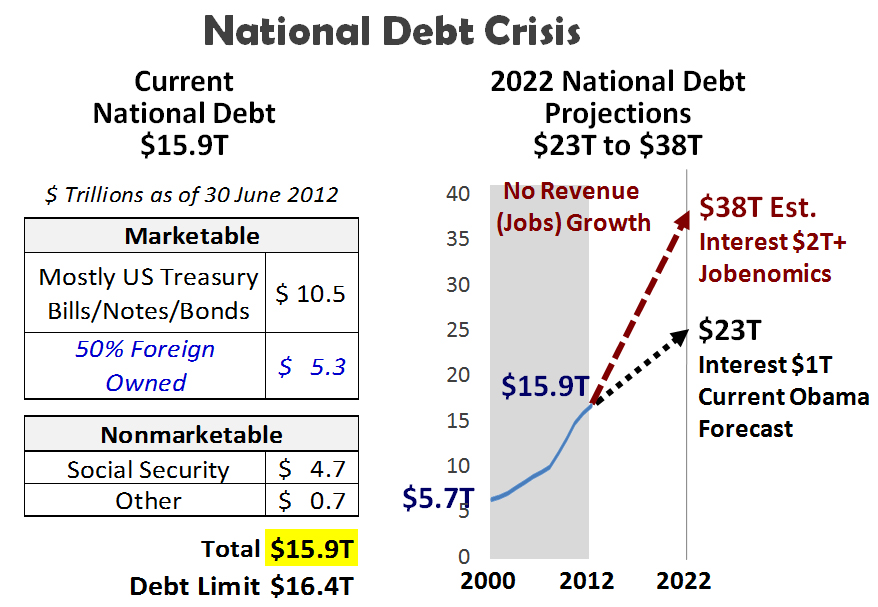

Today our national debt is $15.9T (trillion). America will reach its national debt ceiling of $16.4T in a matter of months. The national debt ceiling is a level imposed by Congress on how much debt the US can carry at any given time. It is likely that this debt ceiling will be increased, but with a lot of political rancor, vitriol and brinksmanship. Since $5.3T of our debt is held by foreigners, political rancor and brinksmanship will not only further erode confidence in America but also empowers the international community to look elsewhere for a new reserve currency not based on the US dollar.

More importantly, the annual interest payment on today’s national debt of $15.9T is approaching $500 billion. According to the President’s FY2013 Budget request, by 2022 the national debt is projected to be $23T with an annual interest payment of $1T. Many believe that this is a best case scenario. If a major recession hits, Jobenomics calculates that our national debt could theoretically skyrocket to $38T with an annual interest payment of $2T. However, the US economy would collapse well before such a number is reached.

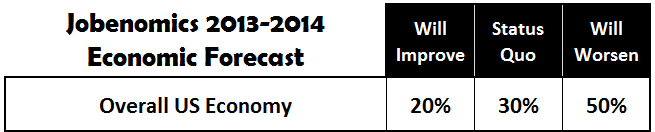

As posted in previous blogs, Jobenomics places the odds at 20% for economic improvement, 30% for the status quo and 50% for the US economy to worsen, perhaps dramatically.

Major positive forces that will effect a sustainable recovery include: the inertia of the world’s biggest economy, the stamina of American small businesses to produce jobs under adverse conditions, American entrepreneurial spirit and our ability to reinvent ourselves, and the current status of the American dollar as the world’s reserve currency which allows the US to print and borrow money. Major disruptive forces include: political gridlock, public and private debt and deficits, high unemployment and erosion of the middle class, recession in Europe and an ongoing eurozone crisis, cooling of emerging economies like China and Brazil, wars, conflicts (especially with Iran and the Arab Spring), asymmetric threats such as cyber warfare, global commodity (energy, food, water) crises, as well as unanticipated Black Swan events such as 9/11.

Unfortunately, negative disruptive forces outnumber the positive. It is imperative that American leadership coalesces on a mutual understanding and a comprehensive plan for America to avoid the January 2013 fiscal cliff as well as a larger national/ global economic crisis.

The author missed the fact that 80M Baby Boomers are preparing for retirement and this will result in a consumer spending downdraft until 2022. This and the rising public debt will drive the US into a depression by 2014.