Successful business is the solution to America’s economic recovery. The good news is that American corporations have successfully recovered from the Great Recession of 2008. However, their success is not universal. Unemployment remains chronically high and the middle class is rapidly eroding. In order to facilitate an economic recovery for all Americans, US corporations need to play a much greater role. Their future depends on it.

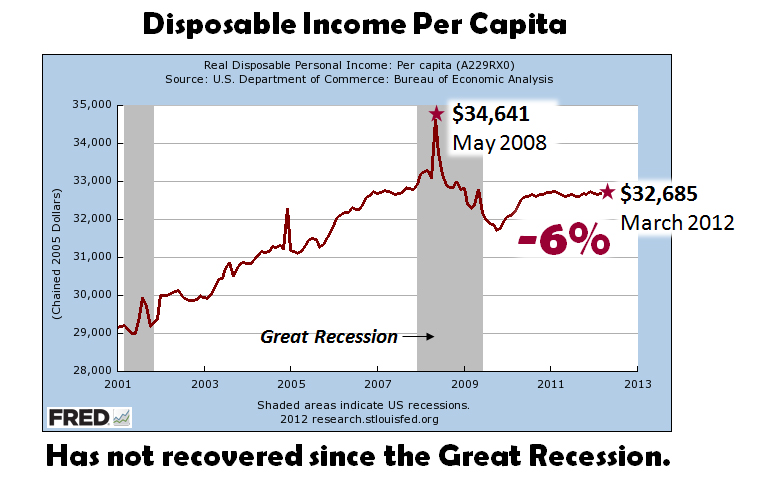

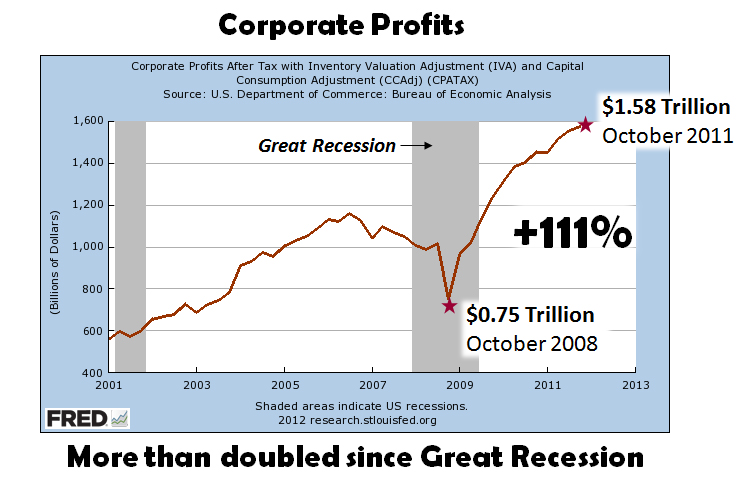

The following two charts from the US Department of Commerce’s Bureau of Economic Analysis (BEA) and the Federal Reserve Economic Data (FRED) contrasts the success story of America’s corporations and languishing fortunes of the average American citizen.

This “Corporate Profits” graph shows that corporate profits have more than doubled (+111%) from $0.75 trillion ($750 billion) in 2008 to $1.58 trillion in October 2011 (latest available data as of May 2012). According to BEA and FRED, US corporate profits are now the highest in US history. Since major corporations are bulwark of our economy, this is very good news.

In contrast, the “Disposable Income Per Capita” graph shows that the average American citizen (per capita or each individual) has decreased -6% over the same period of time from a high of $34,641 in May 2008 to $32,685 in March 2012. Real disposable income per capita income is the portion of personal income that is left after personal taxes are subtracted, and thus is the amount of personal income available to people for consumption spending and saving. Real disposable income per capita income is also an indicator of a country’s standard of living.

So why does Jobenomics make the assertion that the future of US big business depends on deploying its resources to increase America’s overall standard of living?

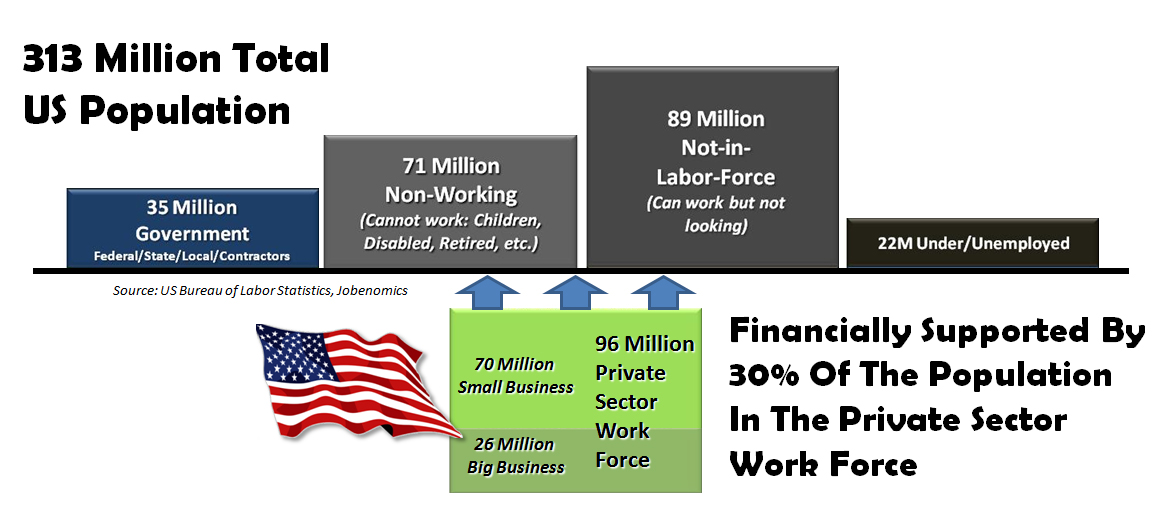

Today, the US population is 313 million people with only 96 million in the private sector work force. These 96 million via familial obligations or paying taxes financially support:

- 89 million who can work but are not looking

- 71 million who cannot work due to age, disability, care-giving, etc.

- 35 million who work for the government.

- 22 million under/unemployed who are looking for work.

Since the Great Recession of 2008, the private sector work force has decreased by almost 5 million people while those “Not-in-Labor-Force” has grown over 9 million alone. In other words, too few are paying for too many.

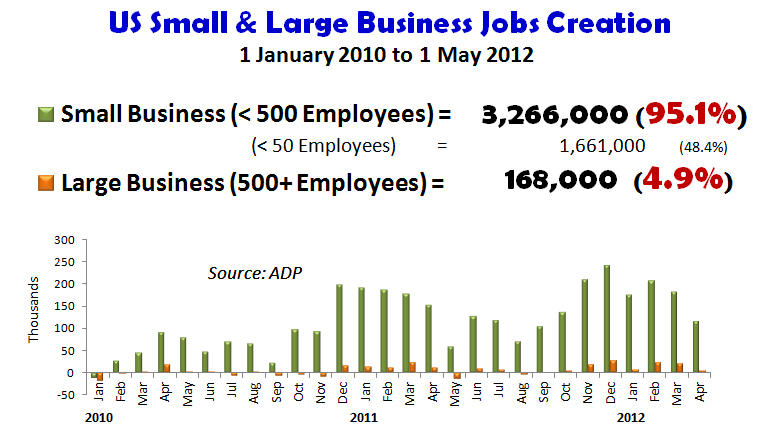

Of the 96 million people in the private sector labor force, the majority (70 million) are employed by small business that was hit hard by the Great Recession. To make matters worse, small business received almost none of the trillions of dollars of federal government stimuli, bailouts and buyouts that went mainly to large financial institutions and corporations. Even though small business still struggles with adverse lending conditions, this community single-handedly produces almost all (95%) of the new American jobs. The following chart shows the contribution to the US labor force since the beginning of this decade. Small business generated 3,266,000 new jobs, whereas big business produced a meager 168,000 jobs.

In many ways, the Great Recession contributed to making American corporations the most productive businesses in the world. Downsizing and eliminating non-productive operations was important for global competitiveness. Now that big business is economically stable, it is time that it becomes socially more responsive.

If big business continues on its current path of hoarding profits and deploying resources overseas in rapidly growing emerging economies, it will face increasing hostility from the American public who are most interested in domestic growth and jobs. Joblessness, income inequality and budget deficits are already major issues. Eventually, corporate taxes will have to rise significantly to cover trillion dollar tax revenue shortfalls that are needed largely for entitlement and welfare payments. As evidenced by recent European elections, electorates favor increased taxes over austerity programs. Corporations have a simple choice either to deploy their profits in ways that create win-win scenarios, or let government bureaucrats tax their profits and use the proceeds that best suits government priorites that often emphasize social over economic issues.

From a Jobenomics perspective, big business should consider small, emerging and self-employed business creation as one of their primary means of deploying a portion of their profits for the common good. While this may seem counterintuitive, small business creation offers many benefits for big business. First it grows the base (96 million) of the private sector work force, which is needed to support government programs and the needs of the non-working population. Second, it grows consumers whose purchasing power represents 70% US GDP. Consumption powers the economy. Decreased consumption public and investor confidence and adversely impacts stock markets. Third, small businesses are more apt to hire the unemployed, thereby alleviating pressure on big businesses to hire unnecessary workers. And lastly, big businesses could benefit from alliances with the small business community to provide specialized skills on a subcontractor basis as well as being public relations advocates for big business that support small business and jobs creation.

Jobenomics offers one example for big business to consider. Jobenomics Harlem is our leading community-based business generator that is designed to produce 1,000 new businesses per year in inner-city Harlem, New York (see Jobenomics Harlem posting). Jobenomics Harlem has secured a micro-business loan from a leading bank for $20 million with a limit of $50,000 for each individual loan. Since Jobenomics intends to clone this program in a hundred other cities, major corporations may want to sponsor a community-based business generator, underwrite micro-business loans, and use their human resources for mentoring and training of new small business tailored to their industry. Energy companies would sponsor green-business and jobs creation opportunities. Industrial companies would sponsor new business specializing in trades most needed in manufacturing.

Many major corporations complain that they are having trouble finding skilled labor for 21th Century jobs. Community-based business generators could focus on training, certifying and starting small businesses to meet the future needs of big business. Not only would corporations help America’s economic recovery, but enhance their public relations while recouping their investments via repayment of the micro-business loans. What small and emerging businesses need most is “patient capital” and sponsors who understand how business works. Business creation should be a role for business as opposed to government. Corporations would be able to get government support and incentives for sponsoring community-based business generations. The Jobenomics team discussed with leading policy-makers the possibility of tax breaks for corporations that repatriate foreign profits for efforts such as this. Their response was very positive.

In conclusion, America’s biggest corporations have largely recovered from the Great Recession. It is now time for them to help others not as fortunate. If corporations fail to do so, voters and legislators will target corporate profits as a major source of tax revenue. Rather than have government bureaucrats deploy their capital, it seems that corporations would prefer to invest in projects like the Jobenomics community-based business generators.