Business, job, wealth and tax revenue creation is the top priority for America. The tyranny of hundreds of trillions of dollars of debt and obligations will dramatically change America, if we do not produce our way out of it. In addition, numerous potential international and domestic crises could derail our nascent recovery. Jobenomics addresses the issues of debt and potential crises as part of the overall strategy to produce jobs, wealth and revenue, whether in good or austere times.

Jobenomics predicts that 2012 will be a pivotal year for the US economy as well as business/jobs creation (see 2012 Jobenomics Outlook article). Economically, the US is skating on thin ice. A major or series of minor economic disruptions could shatter this ice and plunge the economy back into recession. Three potentially large disruptors are: US national debt problems, meltdown in the Eurozone, and conflict with Iran.

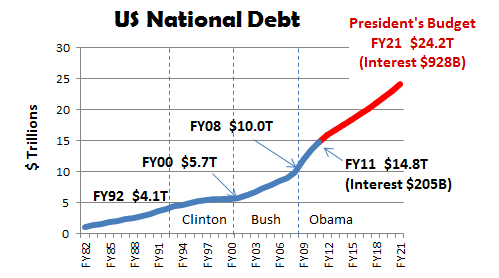

US National Debt Problems. The US national debt is growing at an alarming rate. At the beginning of the Clinton Administration the US national debt was $4.1T (trillion). At the beginning of Bush Administration, it was $5.7T and rapidly grew to $10.0T eight years later due to post-911 conflicts (Iraq and Afghanistan) and implementation of new entitlement programs, like Medicare Part D. During the first three years of the Obama Administration the national debt increased by almost $5T to $14.8T with a 2011 interest payment of $205 billion. According to the Obama Administration’s FY2012 Budget, over the next ten years, the US national debt is projected to grow by almost $10T to $24.2T with a projected annual interest payment of $928 billion.

The Congressional Budget Office estimates the total US national debt to be $27.6T by 2021, an increase of almost $13T.

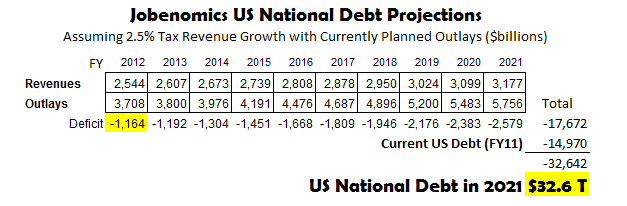

From a Jobenomics perspective, $24.2T or $27.6T by 2021 could be conservative numbers if the economy does not recover or if tax rates are cut in an effort to stimulate the economy. Assuming that US federal government tax revenues grow at 2.5% per year (which is the percentage that the US economy is currently growing) and planned government expenditures continue, the US national debt will reach a whopping $32.6T by 2021. Jobenomics calculations are shown below. Considering that the decade of ‘00s (2000 to 2009) lost one million jobs that were tax revenue producers, a 2.5% growth rate could be considered a conservative number as well.

To understand how significant debt and deficits are, a snapshot of the President’s planned FY2012 outlays and revenues paints a vivid picture. The total US deficit is estimated at -$1.164T for FY2012 (it was -$1.293 in FY2010 and -$1.597 in FY11). This year the federal government plans to receive $2.2T in tax revenues and plans to spend (outlay) $2.3T on mandatory spending programs (e.g., Social Security, Medicare, Medicaid, Interest Payments) and $1.4T on National Security and other discretionary government programs. In other words, mandatory spending of $2.3T for entitlement programs and interest payment will cost more than all the money our government takes in. Consequently, we will have to borrow an additional $1.2T to defend to run government and pay for national security.

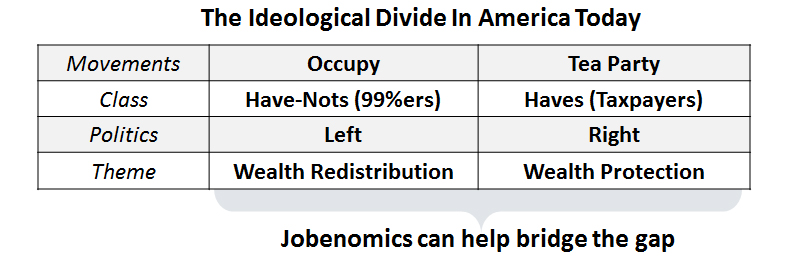

Unless spending is dramatically cut (Tea Party emphasis), or taxes are significantly increased (Occupy Movement emphasis on taxing the top 1%), or tax revenues dramatically increase via a growing economy (Jobenomics emphasis via small, emerging and self-employed business creation), huge annual deficits will continue for the remainder of this decade. Whether the US national debt is $24T (President), $28T (CBO) or $33T (Jobenomics @ 2.5% revenue growth) is largely academic. The US economy is likely to collapse under any of these scenarios.

Compared to other grassroots movements, Jobenomics national grassroots effort is small but growing rapidly. With its focus on middle-class business and job creation, Jobenomics can help bridge the gap of America’s ideological divide regarding US debt spending and receipts. Jobenomics appeals to the left and right, rich and poor, urban and rural, and members of all political parties. Small, emerging and self-employed business creation is the only realistic way to increase tax revenue and reduce welfare spending by putting people back to work.

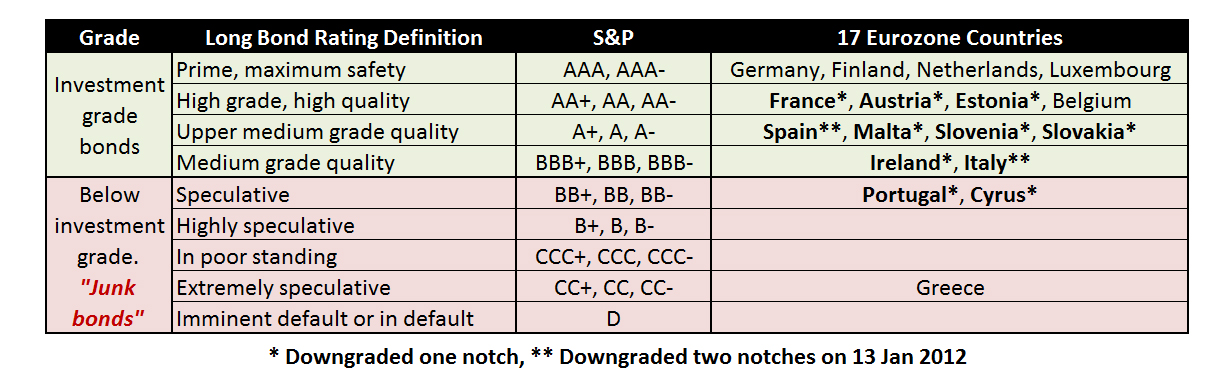

Eurozone Meltdown? The global financial community is watching the PIGS, which is a derogatory acronym for Portugal, Italy, Greece and Spain. All of these countries are in financial turmoil. All are in recession. All have serious debt issues and are considering bankruptcy and strategic defaults as ways to escape their debt burden. Moreover, the PIGS are threatening the financial stability of the entire European Union (EU), which is bifurcating into have nations (France, Germany, UK) nations that have stable economies, and have-not nations (PIGS) that are skating near the edge of financial abyss.

Like any family, financial issues generally bring out the worst in people. This is no exception in the 27-nation European Union where 17 nations share the euro as a common currency. Traditional rivalries, like those between Germany and France, as well as Eastern and Western Europe are beginning to intensify as financial difficulties continue to worsen with the PIGS. While the PIGS are in the worst trouble, they are not unique. Thirteen of the 27 EU members face debts equal to more than 60% of their GDP, the limit set by the European Commission.

There is mounting concern that Greece will be unable to finance a budget deficit, which is more than four times the EU’s debt limit, or make payments on its sovereign debt. A Greek default has far-reaching financial and political implications for the EU, which by charter constitutes a single market. If one part of its market is allowed to fail, what does that mean for the viability of the entire market? The term that most economists and policymakers use is “contagion.” They are as much concerned about the Greek contagion spreading as the Greek crisis itself.

Many fear that the Greek contagion will spread to Portugal, Spain and Italy whose credit ratings are also falling. If this continues, financial institution and investors will be unwilling to continue to fund these countries. Without the ability to sell bonds or borrow money, these countries will default on their debts and sovereign obligations. Default will put significant pressure on European banks that own securities from these countries. The European Central Bank (the EU equivalent of the US Fed) controls the monetary policy of the Eurozone member states. It is also the major source of funding for countries like Greece, and could face major losses on its own loan portfolio if Greek banks fail and the government defaults.

There is significant evidence that the Greek contagion is spreading. On 13 Jan 2012, the S&P Credit Rating agency downgraded 9 of the 17 Eurozone countries. France and Austria lost their coveted AAA ratings, which were lowered one notch to AA+, and Italy and Spain had their ratings cut by two notches. Germany, Finland, Luxembourg and the Netherlands all retained their AAA status, while the ratings of Portugal and Cyprus were cut to junk, thereby joining Greece which is one notch away from default.

A Eurozone meltdown or a PIGS contagion will not only spread throughout the EU, but will engulf US public and private financial institutions that are heavily invested in Europe. No other economic relationship in the world is as integrated as the transatlantic EU/US economies. The EU and the US economies account together for about half the entire world GDP and for nearly a third of world trade flows. The transatlantic relationship also defines the shape of the global economy. Consequently if Europe plunges into recession, it will likely pull the US back into recession as well.

Conflict with the Islamic Republic of Iran . Of all the military and terrorist threats facing the US, war with Iran has th e most menacing consequences from both security and economic standpoints. A detailed presentation, entitled Conflict with the Islamic Republic of Iran, was written by this author in 1996, and reviewed by the Joint Chiefs of Staff and the leading military war colleges. A downloadable copy can be obtained at by clicking: Conflict with the Islamic Republic of Iran.

e most menacing consequences from both security and economic standpoints. A detailed presentation, entitled Conflict with the Islamic Republic of Iran, was written by this author in 1996, and reviewed by the Joint Chiefs of Staff and the leading military war colleges. A downloadable copy can be obtained at by clicking: Conflict with the Islamic Republic of Iran.

Jobenomics, the book published in 2010, has the following information about a conflict with Iran and its economic disruptive potential.

Iran is provoking a conflict with the West, using American and Israeli occupation in the Middle East as the cause célèbre for Islamic common cause. However, there are more fundamental reasons motivating the Ayatollahs and the leaders of the Islamic Republic of Iran. These reasons include:

- Political: Supreme Leader Ali Khamenei and President Mahmoud Ahmadinejad repeatedly state that their primary political objective is to revive the crumbling Islamic Revolution. An external enemy helps advance the ultra-conservative position over reformers and youth who want détente with the West.

- Economic: Control of 50% of the world’s oil reserves greatly benefits Iran. Increasing economic sanctions will either motivate Iranian leaders towards moderation or encourage aggressiveness.

- Military: Compared to a hundred thousand US forces and diplomats in neighboring Iraq and Afghanistan, the Islamic Republic has several million combat personnel strategically positioned to dominate the region. Additionally, they openly state their right to develop a nuclear capability.

- Religious: Messianically-inclined Shia leaders are preparing for confrontation with Israel and America, the expected near-term return of the Islamic messiah, and the establishment of a global Caliphate.

- Historical: Confederacy with Shiite communities throughout the Middle-East (starting with Iraq, Bahrain, and Saudi Arabia) is a historic opportunity after 1,000 years of domination from Sunni Arabs and Ottoman Turks.

The Iranian leaders have repeatedly stated that war with the West is inevitable. Iran is currently engaged in a war of words and saber rattling. When they achieve nuclear weapons capability, their rhetoric may turn to military action, especially if they feel that they are about to be attacked by Israel and Israel’s Western allies.

Military planners foresee three possible engagement scenarios: closing the Strait of Hormuz, military action against Israel, and military action against America either at home (terrorist attack) or abroad.

- Strait of Hormuz. Closing the Strait of Hormuz would create a global energy and economic crisis. The Strait of Hormuz is of great strategic importance. It is the only sea route through which oil from Kuwait, Iraq, Iran, Saudi Arabia, Bahrain, Qatar, and the United Arab Emirates, can be transported to the rest of the world. Approximately 20% of the world’s oil supplies transit the narrow Strait of Hormuz. The strait at its narrowest is 21 miles wide with two 1-mile wide channels for marine traffic. Iran has conducted several major naval exercises to showcase its capability to close the Strait of Hormuz and Supreme Leader Ali Khamenei has publicly stated that Iran will close the Strait if provoked. If the Strait is closed, the price of oil could quadruple overnight. More importantly, the disruption of the flow of oil would quickly impact the economies of numerous nations.

- Military action against Israel. President Ahmadinejad has stated on numerous occasions that Iran intends to “wipe Israel off the map,” “very soon,” with a single decisive blow. Preemptive military action against Israel would likely entail a coordinated missile attack, including 40,000 short-range rockets (Katyusha), hundreds of medium-range missiles (Scud) and a few nuclear-tipped theater ballistic missiles (Shehab). Israeli leadership takes these threats seriously and is considering preemptive military action of its own, which could include the use of nuclear weapons. The use of nuclear weapons by either side, or military intervention by the US or Israel to destroy Iranian nuclear development sites, would have major consequences in the global political/economic balance-of-power. It is hard to foresee any outcome that would benefit the US economically or otherwise.

- Military action against America at home or abroad. As a result of the 1980-1988 Iran-Iraq War, the longest conventional war in the 20th Century, the Iranian military has maintained the bulk of their 32 divisions and 87 brigades, most of which are stationed on the Iraqi border. Several million Iranian troops, along with Iranian special operation forces (Qods) already in Iraq, could quickly overwhelm the fledgling democracy Iraq. Any such action would precipitate a major military response from the US. To counter this response, the Iranians would likely create diversionary or retaliatory attacks within the US. The types of terrorist actions that they could inflict within the US have been the subject of much conjecture and study. The most serious types of attacks would cause massive loss of life and devastating economic impact. To accomplish an Iranian version of shock-and-awe, bio-terrorism, dirty bombs, or an offshore EMP explosion would be the most devastating. According to the US Commission to Assess the Threat to the US from Electromagnetic Pulse (EMP), “Because of the ubiquitous dependence of US society on the electrical power system, its vulnerability to an EMP attack, coupled with the EMP’s particular damage mechanisms, creates the possibility of long-term, catastrophic consequences.”

From a strategic perspective, Iran is the lynchpin in a larger strategic equation that involves both Russia and China, both of which support Iran politically, militarily and economically. If Iran is successful in establishing itself as the dominant regional power in the Middle East, the global geo-political center would shift increasingly from the West to the East.