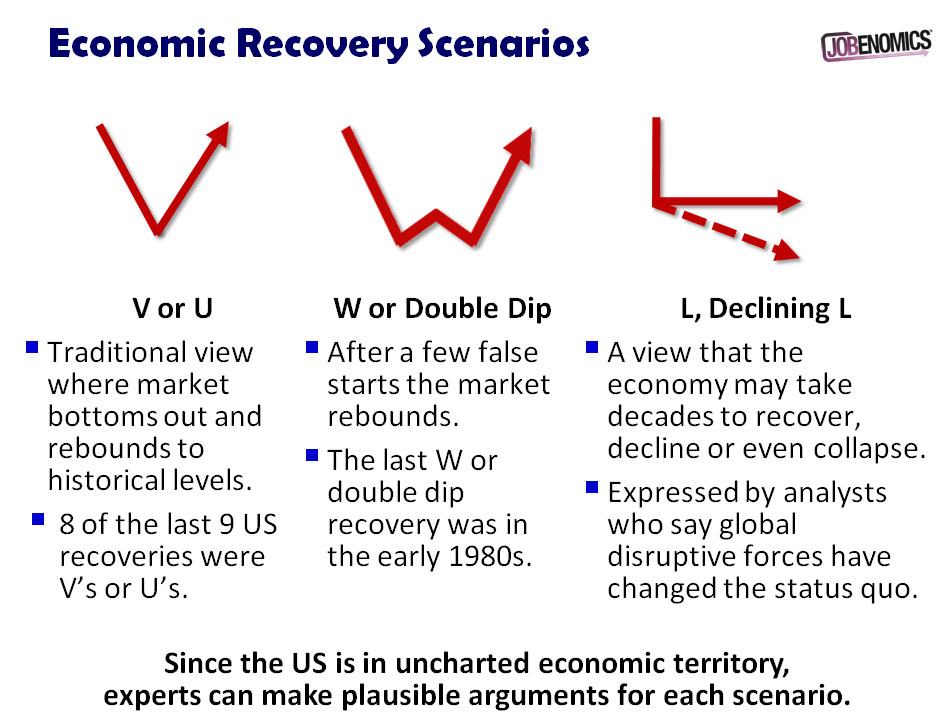

There is much debate among economists and policymakers about the shape of the US recovery. From a Jobenomics perspective, there are three scenarios: V, W, and L or declining-L.

V-Shaped Scenario. The V-shaped scenario is the predominant historical scenario. The premise of a V-shaped recovery is that the market rebounds after hitting bottom, and returns to or exceeds previous highs. Eight out of the nine recessions that the US has experienced since WWII have been V-shaped recoveries.

Due to rebounding US stock markets (Dow, S&P and NASDAQ), policymakers tout the V as proof that recovery is underway, and that government stimulus packages are working. Economists further argue that the normal business cycles are a series of peaks and troughs. Recessions (troughs) are distinctly shallower, briefer, and less frequent than expansions (peaks). Since the US economy is still the largest and most powerful in the world, Americans should expect a peak greater than before. While the current recession (aka, The Great Recession) has been bad, our current economic balance sheet is no worse than it was a decade ago.

W-Shaped or Double-Dip Scenario. The W-shaped scenario happened during the 1975 to 1982 recessionary era. It also happened during the Great Depression. The premise is the market rebounds, then decreases, and rebounds again returning to historic highs. The W is a double V, also known as a double-dip recession. After a false start, optimism returns to the marketplace. Past W-shaped scenarios were largely caused by excessive or inappropriate government policies and intervention. A future double-dip recession could be induced by another domestic financial crisis or an international event.

L- or Declining-L Shaped Scenario. The L-shaped scenario has not happened in recent US history, but has occurred numerous times in other countries, like Japan and Greece. The L-shaped recovery premise is that the market does not rebound, or takes a significant amount of time before it rebounds. The “declining” L postulates that the economy erodes, and in extreme cases, collapses. The square root symbol is a third variant, where the recovery dips, recovers slightly (due to stimuli), and then flattens. Economists who believe that the current economic crisis has been caused by flawed economic principles endorse the L. Numerous anti-capitalists also ascribe to this point of view since they believe that the American-era is over, and is in decline. Even V and W advocates acknowledge that multiple crises, or a catastrophic event, could cause an L, or even a declining L, depending on the severity of the crisis or event.

A reasonable case can be made for each scenario, which implies that there is 2/3 chance that the US economy will get worse in 2012. This reflects the dour mood of Americans, who by a 2/3 margin believe that the US economy is moving in the wrong direction. It is the author’s opinion that the US economy will continue to struggle with low GDP and high unemployment rates, but will eventually recover if there are no major crises. However, this is a very large “if”. Dark clouds are on the horizon. These clouds include a deadlocked political environment in Washington, eurozone crisis , conflict with Iran, a massive energy crisis ($300 barrel of oil), a second major real estate crisis, layoffs by state and local governments, terrorist (cyber, or physical) attacks, civil unrest, or an unanticipated “black swan” event.

Consequently, if American leadership (Bernanke, Geithner, Obama and Congressional leaders) make the right monetary (the Fed) and fiscal (the Congress) decisions, our economy shouldslowly recover (V-shaped recovery). If a financial, manmade, or natural crisis occurs, America is likely to suffer a

double dip (W) recession that will lead to economic malaise and higher unemployment rates. If multiple crises occur, the US economy could enter a prolonged era of recession (L), or depression (declining-L), which is an increasingly likely prospect for the eurozone. 2012 will certainly be a pivotal year for America and the other Western economies.